Tata’s ₹27,000 crore semiconductor plant in Assam isn’t just a tech investment—it’s a transformative moment for Northeast India. Abhishek Kumar unpacks how the region’s unique policy, resource, and talent advantages can position it as India’s next semiconductor hub, driving inclusive, high-tech growth across sectors.

- India’s Semiconductor Ambition: A National Imperative

India has begun an ambitious journey to become a major player in the global semiconductor landscape. This strategic push began with the announcement of the India Semiconductor Mission (ISM) in December 2021 with a budget of ₹76,000 crore (US$9 billion).

ISM’s goal is to establish a sustainable semiconductor and display manufacturing ecosystem in India. Specifically, operating under MeitY, it aims to establish fabs (fabrication units), OSAT (Outsourced Semiconductor Assembly and Test) facilities, and ATMP (Assembly, Test, Mark and Pack) units in India, reduce India’s dependency on imports, and foster innovation through schemes namely the Design Linked Incentive (DLI) for start-ups and MSMEs.

![]()

The Indian semiconductor market, valued at $52 billion in 2024 and projected to reach $103 billion by 2030, is driven largely by booming demand from automotive (especially EVs), electronics manufacturing, and IT sectors. The global reshoring trends of manufacturing industries due to geopolitical tensions, environmental deterioration, and economic threats emphasizes the need for secure local production.

India’s staged semiconductor manufacturing strategy begins with ATMP/OSAT (the majority of global semiconductor assembly and test facilities) so that they can build capabilities and supply networks before going into full-scale fabrication.

The centrepiece of these initiatives is Tata Electronics’ greenfield semiconductor assembly and test facility in Jagiroad, Assam, a ₹27,000 crore (US$3.6 billion) project approved on February 29, 2024, with the foundation stone laid on August 3, 2024. This facility is envisioned as a strategic anchor for India’s ATP segment and a key step in making India a leader in the global semiconductor supply chain.

- Why was Assam chosen for this massive project?

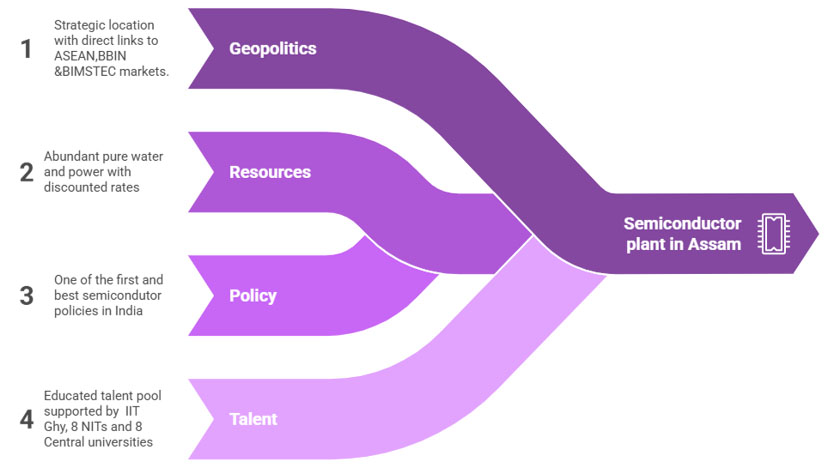

The selection of Assam reflects a junction of geopolitics, resources, and policy in the following ways:

- Policy: Assam has set itself apart by being among the first states to declare a very competitive semiconductor policy in August of 2023. This policy offers substantial fiscal incentives, providing a 40% extra capex subsidy on top of central incentives which is higher than states like Gujrat, UP and Tamil Nadu which provide only 20-25% subsidy. The policy also provides tax breaks, power rebates, and thorough facilitation with emphasis on fabs, ATMP, and OSAT, thereby making Assam quite investor friendly.

- Resources: Assam’s resource advantages bolster its semiconductor potential. Ultra-pure water and stable power—critical for chipmaking—are ensured by the Brahmaputra (India’s largest river by volume) and 14 GW of renewable energy potential. The state offers potable water at ₹5/m³ and power tariff incentives of up to 50% for 10 years, significantly cheaper than Gujarat (₹12/m³). To scale clean energy, Assam aims to add 11.7 GW of capacity by 2030 under its Integrated Clean Energy (ICE) Policy 2025, which supports green projects with duty reimbursements and tariff subsidies.

- Geopolitics: Assam’s geographical location also offers a strategic advantage as it links Northeast India to ASEAN markets and neighbouring BBIN and BIMSTEC regions over 5,182 km of international borders under India’s Act East Policy. Upcoming multimodal corridors including rail links like Kokrajhar-Gelephu, the Brahmaputra waterway, the proposed Assam Electronics & Semiconductor Logistics Park (AESLP) and the development of a tech park and ESDM cluster over 100 acres in Jagiroad —offer seamless connectivity to packaging hubs in Taiwan, Malaysia, Vietnam, and Singapore.

- Talent: The Northeast, including Assam, provides a sizable and always expanding pool of educated talent as well. Supported by institutions including IIT Guwahati, eight NITs, eight Central universities, and industry academic collaborations, they provide qualified VLSI and chip design experts. A young, English-speaking workforce in a pollution-free surrounding promises to draw expatriate professionals vital in early stages.

All these factors taken together produce a low risk proposition for high tech investment.

- Socio-economic effects of the plant on Northeast India

The construction of the semiconductor facility in Jagiroad has the potential to cause significant socioeconomic changes throughout Northeast India, extending far beyond the factory gates.

Employment and upskilling

The Jagiroad plant is expected to generate over 25,000 jobs—15,000 direct and 11,000–13,000 indirect which marks a shift from traditional agriculture and resource mining to advanced technology employment driving a fundamental improvement of the human capital of the region.

Nationally, the semiconductor mission targets 25,000 direct and 60,000 indirect jobs, supported by skill programs training 85,000 professionals across B.Tech, M.Tech, and PhD levels, across 113 academic institutions, nine of which are in the Northeast. Along with NIELIT and Gauhati University’s partnerships, programs like “Chips to Startup (C2S)” at IIT-Guwahati and NIT-Silchar are aggressively producing semiconductor talent.

These high value employment prospects are also expected to lower youth migration, retain intellectual capital, and boost local entrepreneurship which can help to mitigate historical problems of “cultural disconnect” and promote shared economic prosperity.

Ancillary businesses

Supporting businesses pertaining to logistics, maintenance, raw materials, specialized services will flourish all around the plant in a cluster form. The presence of a major player like Tata will also encourage local businesses and MSMEs to integrate into the value chain as suppliers, expanding the regional industrial base.

The influx of highly skilled professionals and increasing industrial activity will also naturally boost other sectors including real estate, transportation, and hospitality fostering a dynamic and diverse workforce.

![]()

Knowledge based economy

By diversifying away from its conventional economic drivers of agriculture, tea production, and resource mining towards a technologically driven, knowledge-based economy, Northeast’s economy will become resilient against outside shocks and bring in private investment.

Alongside this project, Reliance and Adani have also pledged to invest ₹75,000cr and ₹50,000cr respectively in the NE region. All these investments will lead to even more industrialization, employment generation, and infrastructure improvements across verticals which will be very helpful in upbringing the community as a whole.

- Can Northeast become India’s next semiconductor hub? What needs to be done.

Tata’s Jagiroad factory can be the linchpin for a Northeast semiconductor cluster. In fact, global chip-ecosystem players are already lining up with firms like ASMPT, DISCO, BESI, Cadence and Tokyo Electron setting up local presences, and Tata planning MoUs with 10 more companies to “boost the ecosystem”.

But in order to become a full semiconductor hub, the Northeast needs to leverage its unique abilities and draw the whole value chain—from upstream R&D, design, and material production to downstream electronics manufacturing and product development.

What the local Governments need to do?

For state governments, consistent policy support is absolutely vital. This covers maintaining and possibly improving incentives to compete internationally as well as guaranteeing perfect policy execution to lower bureaucratic delays. Key focus should be on establishing world-class research centres in semiconductor materials, design, and manufacturing, supporting academia-industry cooperation, and building research parks and innovation hubs for startups by means of R&D investments.

![]()

Governments should also leverage the “China Plus One” strategy by aggressively highlighting North East’s special advantages. Relaxed land regulations under EMC 2.0 will help actively promoting specialized zones including electronics manufacturing clusters (EMCs) and SEZs like Tinsukia and Guwahati-Baihata Chariali. One step in this regard is the planned Assam Electronics & Semiconductor Logistics Park (AESLP).

Strengthening infrastructure including consistent high-quality power, effective water systems, and strong multimodal logistics—roads, rail, rivers, air cargo are also of paramount importance.

Building a strong talent pipeline is also important. Expanding technical curricula (VLSI design, chip testing, AI) at universities and polytechnics will be vital. Apprenticeships and certifications tied to the Tata plant can upskill local youth.

What the people need to do?

Local involvement is equally vital. Supported by government grants and seed money, entrepreneurs and MSMEs should be urged to participate in the semiconductor value chain—from raw materials to specialized services. The youth should be motivated to pursue STEM verticals. The culture of migrating outside the Northeast in search of “better opportunities” needs to be mitigated.

To thrive in the evolving knowledge-based economy, individuals must embrace continuous skill development, particularly in high-tech fields like VLSI design, IC manufacturing, and advanced packaging—through programs offered by institutions such as IIT-Guwahati and NIELIT.

Given the semiconductor industry’s rapid technological rise and emphasis on precision, the workforce must remain adaptable, pursue ongoing training, and commit to excellence to meet global standards building a reputation for reliability internationally.

- Conclusion: Northeast India’s Pivotal Role in India’s Tech Future

Through Tata’s Jagiroad facility, the Northeast enter a new era marked by the shift from primary sectors to a knowledge-driven economy. This project is much more than just a chip manufacturing facility; it is a key driver of regional development, with the potential to create a large number of direct and indirect jobs, support the expansion of many ancillary industries, and propel important infrastructure improvements throughout the area.

The Northeast has the perfect opportunity to spearhead India’s semiconductor aspirations thanks to its innovative state policy, wealth of resources, advantageous location, and growing talent pool. But in order to fully realize the potential of this “Silicon Dawn,” industry, academia, and the central and state governments must continue to work together in the areas of infrastructure, R&D, skill development, and policy implementation.

With Assam at the forefront, Northeast India is poised to become a crucial and indispensable player as India strives for semiconductor self-reliance and become a global electronics hub by 2030. This region exemplifies inclusive and sustainable industrial growth in line with the vision of “Viksit Bharat, Viksit Northeast.” How far this vision takes the Northeast, only time can tell; But the direction is clear: from the banks of the Brahmaputra to the global chip supply chain, a high-tech future is unfolding.

Abhishek Kumar

Abhishek Kumar is a strategy consulting intern at Avalon consulting. Currently pursuing an MBA from IIM indore, he has prior work experience as an IT and software engineer at Target Corp - the American retail giant, where he drove enterprise technology initiatives by managing critical IT infrastructure, optimizing systems for scale, security, and performance to support core business operations. He holds a degree in Electronics and telecommunication engineering from Jadavpur University, Kolkata and was born and brought up in Shillong, Meghalaya.