Ayush Patodia, Associate Vice President, and Jatin Dang, Consultant at Avalon Consulting, shared their views on Decoding the Microdrama Industry: Stories May Have Shrunk, but Their Reach Has Grown, which was published in MediaBrief.

They highlighted how microdramas short, mobile-first storytelling formats are rapidly gaining traction by aligning with changing consumer attention spans and platform-driven consumption habits. The article explores how this format is expanding reach, opening new monetisation avenues, and reshaping content strategies for creators and brands in India’s digital media ecosystem.

Maggie takes two minutes, watching an entire episode of a series could take even less. Gone are the days when a single episode used to stretch between 30-60 minutes, today’s soaps are being reimagined for the mobile first engagement economy. A new wave of storytelling is shrinking them into bite-sized, cliffhanger driven snackable episodes.

Welcome to the world of microdrama or duǎnjù as they’re called in Chinese – a vertically formatted video series, usually 20 to 100 episodes long and designed for mobile first consumption. With each episode’s run time being one to three minutes – they fit perfectly into everyday moments like cooking, commuting to work, or scrolling before bed.

The appeal of the format rests on three key elements- serialized storytelling, cliffhangers and instant gratification. Together they make the perfect recipe to keep young audience particularly Gen-Z and millennials hooked to their mobile screens.

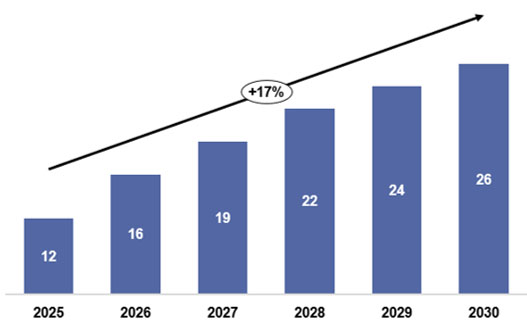

Across the globe this industry is expanding rapidly and is projected to grow at a CAGR of nearly 17% from $12 billion in 2025 and to $26 billion by 2030.

Exhibit 1: Global Micro-drama Monetization (Total Revenue in US$ Bil.)

Source: Media Partners Asia

China is currently dominating this market. In FY24 it produced more than 5,000 series, reaching over 662 million domestic viewers. These series generated ¥67 billion (about $9.4 billion) in revenue in FY25, surpassing the country’s traditional box office. On Kuaishou, one of the biggest short video platforms in China more than 270 million people watch microdramas daily. Of these 94 million are paid users binge-watching over 10 episodes daily- a 50% increase from last year.

Microdramas are gaining traction in the US as well. ReelShort, one of the leading microdrama apps, climbed the app stores ranking – at one point surpassing TikTok in downloads and even outranking Netflix on certain metrics.

India even though a little late to the trend, is catching up very quickly. As per reports, the microdrama industry in India is projected to reach $5 billion in the next five years.

Key drivers fuelling this growth

- Shrinking attention span: According to a Microsoft study the average attention span of humans has dropped from 12 seconds in 2000 to just 8 seconds in 2025 now only a second shorter than that of a goldfish.

- Smartphone usage: The number of smartphone users worldwide has reached 7.21 billion* which is about 90% of the global population. In India, however the smartphone penetration remains relatively low only 46% of people own a smartphone highlighting a huge untapped potential and growth opportunity.

- Rising screen time: Globally people spend on an average 3 hours and 43 minutes on their smartphones each day. In India that figure increase to 4 hours and 5 minutes which is nearly half an hour longer than the global average.

- Shortform content boom: In India YouTube Shorts have surpassed 1 trillion views while Instagram and Facebooks Reels are watched over 140 billion times each day suggesting a growing appetite for bite sized content

Note: The figure doesn’t mean that 90% of individuals own a smartphone. Instead, the number is inflated because many people use more than one device

Who are the key players in India?

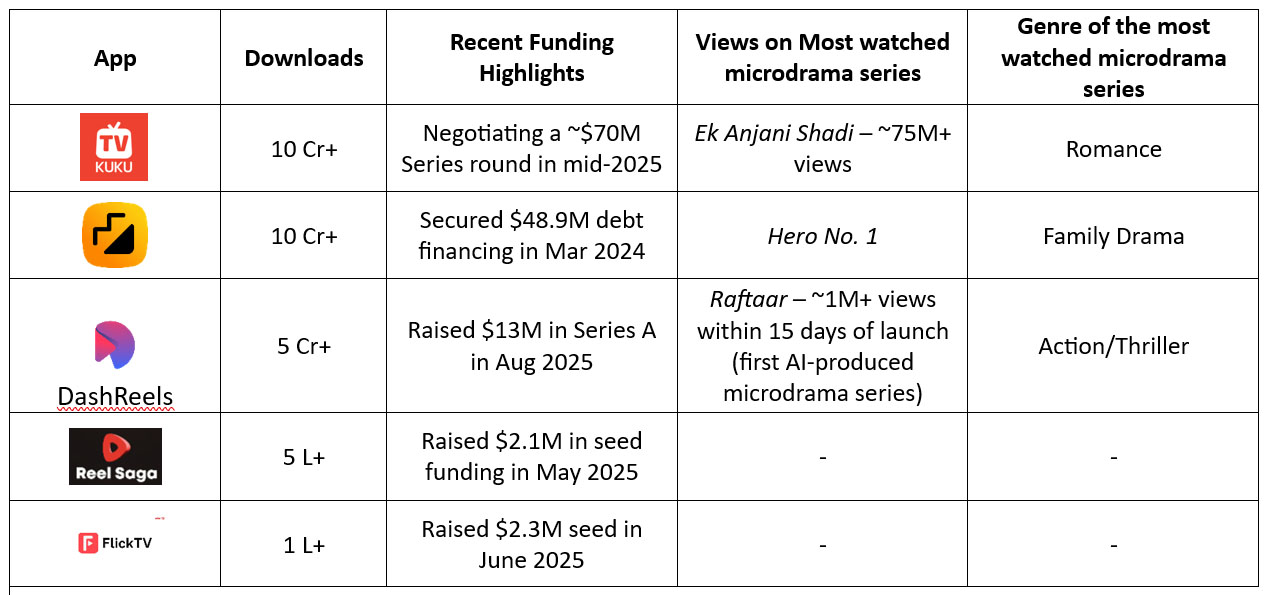

Emerging startups such as Kuku TV, DashReels, Reel Saga, Flick TV, and Moj are the frontrunners, shaping the contours of India’s microdrama landscape.

Exhibit 2: Leading Microdrama Platforms in India

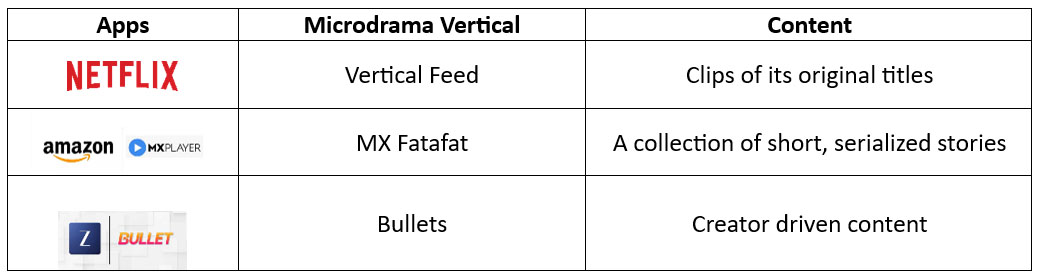

Legacy players are also catching up. Netflix is experimenting a mobile-only vertical feed that lets users scroll seamlessly through clips of its original titles. Amazon’s MX Player has introduced MX Fatafat, while Zee Studio has launched Bullet both dedicated verticals for microdrama.

Exhibit 3: Mainstream OTT Players Launching Microdrama Verticals in India

Following the passage of the Promotion and Regulation of Online Gaming Bill in August 2025, which banned real-money gaming apps, several platforms began pivoting to microdrama. Winzo launched Winzo TV, while Zupee introduced Zupee Studio both are dedicated verticals for short-form storytelling.

According to the FICCI–EY report, at least 20 apps, new or existing, are expected to enter this space in the coming years. Considering India’s diverse linguistic landscape, platforms offering regional-language content are likely to hold a strong competitive edge.

How is microdrama different from a conventional OTT serial?

Apart from the duration of an episode and the vertical format, the key differentiators are the production cost and turnaround time (TAT).

A typical OTT series costs ₹15–20 crores to produce and is usually backed by major production houses. In contrast, microdramas can be produced at a fraction of that cost, around ₹10–15 lakhs on an average, and in some cases for less than ₹50,000.

Lower cost of production enables greater experimentation and creative risk taking. With the growing use of AI in scripting, editing, and visual effects, barriers to entry are even lower, particularly for genres such as science fiction, medieval history, or mythology which traditionally demand higher production budgets.

Production duration is another differentiator. An OTT series takes on an average 9-12 months to produce, while microdramas are created in just 7-10 days, allowing content to be produced at a much lower cost.

Another major difference lies in casting. An OTT series often feature well known and recognizable actors, including Bollywood stars to draw audiences and justify large budgets. Microdramas on the other hand provide a platform for newcomers, theatre actors, social-media influencers, and emerging talent.

Business model of Microdrama platforms

In China and the US, the majority of microdrama platforms follow a freemium model where the first few episodes are free while later ones require payment to access. India presents a different challenge. As a price sensitive market with low average revenue per user (ARPU) freemium model may prove less effective. Despite this some platforms are experimenting with pay per episode formats while others are exploring a weekly or a monthly subscription.

Another approach could be the advertising-based video on demand (AVoD) model in which viewers watch ads in exchange for episodes. With this model businesses can achieve scale, but only up to a certain level and it will be difficult to grow beyond that point.

A more promising path may lie in a hybrid strategy borrowing from YouTube’s playbook: combining subscriptions with ad-supported revenues so users can pay for an ad-free experience while others remain on the free ad-based tier.

Conclusion

Even though microdramas are at a nascent stage currently, but they hold strong potential to disrupt the entertainment space. They are unlikely to replace OTT platforms or the traditional film industry, instead they will coexist while serving as an alternative to YouTube Shorts and Reels. Put simply, the stories may have shrunk, but the reach has expanded dramatically.