The Indian film industry is witnessing a structural shift post-Covid-19, with the rise of non-Hindi cinema, evolving audience preferences, and the growing importance of content over star power. As regional films gain pan-India appeal, collaborations, OTT partnerships, and innovative marketing are shaping the industry’s future. Vigneshkumar’s article explores key trends and outlines the path forward for this dynamic landscape.

The Indian film industry, a global giant, released ~2000 films in 2024 across 15+ languages. The industry across decades has been thriving on its rich artistic history, young population, and rising incomes. Post-Covid-19 though, the industry has been witnessing a structural shift with blurring lines between regional cinema and “Bollywood”. Increased collaborations among production houses, crew, actors, and audiences across languages are evident. Key trends and audience preferences are evolving, shaping a new way forward for the diverse Indian film landscape.

In this article, we will identify certain major trends observed in the Indian film industry, decode the voice of the Indian film-watching audience and the way forward for the industry.

Paradigm Shifts – Gradual but Irreversible?

- Hindi film releases – a downward spiral

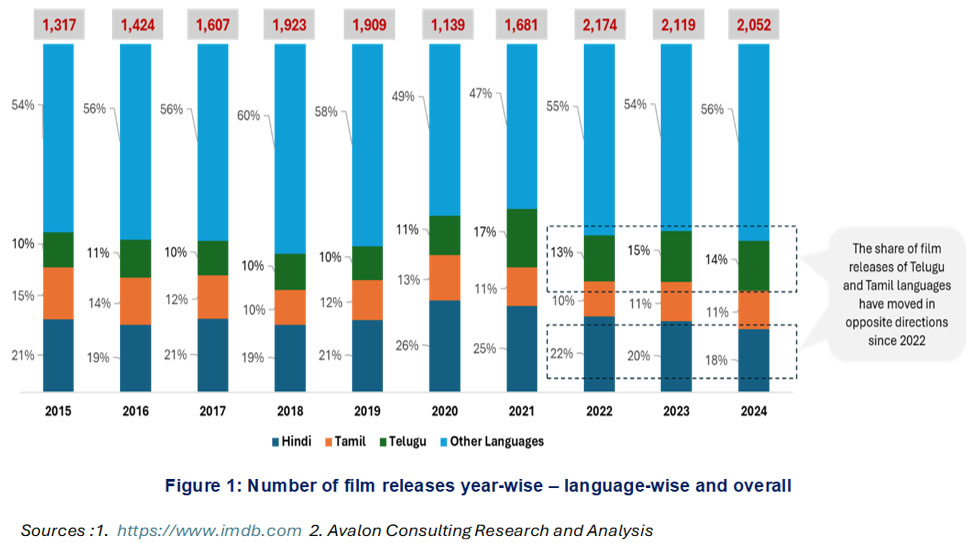

The Indian film industry registered a degrowth of ~3% in terms of number of films released in 2024, as per IMDb data. However, a closer look reveals that the Hindi film industry, which is the largest, registered a steep fall of ~14%. The share of Hindi films in the overall mix was 18% – the lowest over the last decade. Since 2022, the share of non-Hindi films in the overall mix has been increasing. The Telugu films over this period have increased their dominance, with their share increasing from ~10% pre-2020 to ~15% in 2024.

- Soaring audience approval – non-Hindi films

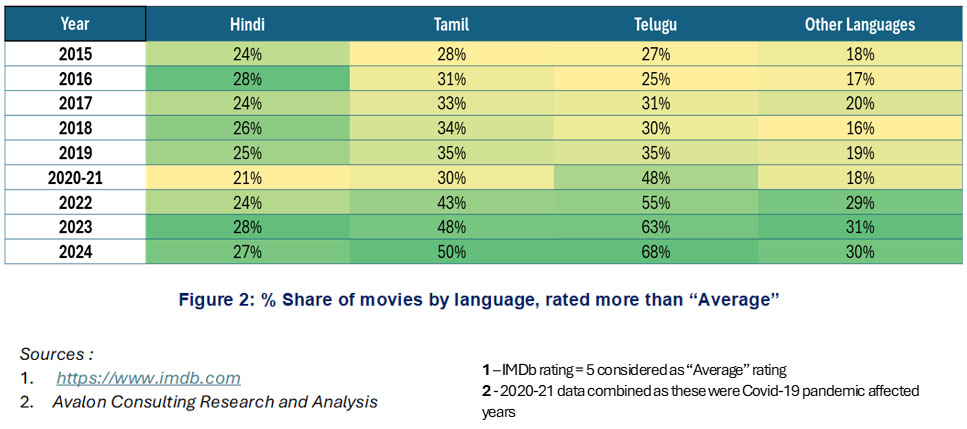

Over the last decade, the share of non-Hindi films garnering approval has consistently improved. Since 2015, the share of Hindi films rated above “average” has been ranging from 25%-30%, however, for Tamil and Telugu films, the corresponding figure reached ~50% and ~70% respectively in 2024. Even for other languages the audience approval ratings above the “average” mark have improved.

- Shifting grounds – South Indian to Pan Indian

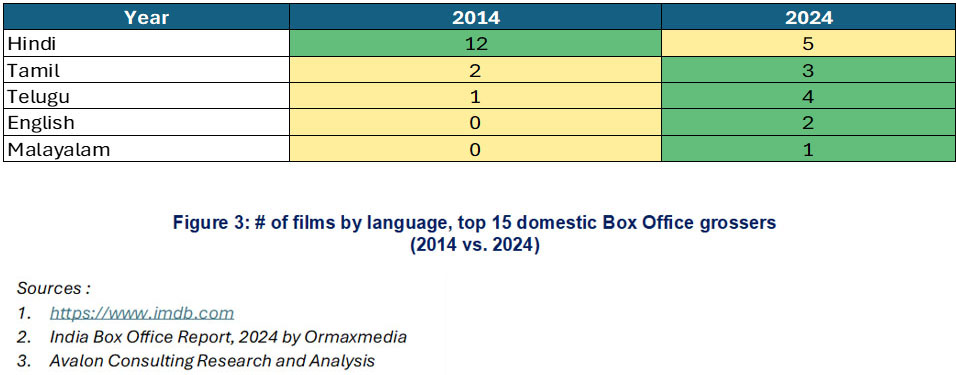

In 2024, more than 50% of the top 15 highest domestic Box Office grossers were South Indian. Even 2 English films made it to the list. Compare this with 2014 – a whopping 80% of the top 15 Box Office grossers were Hindi films, rest being South Indian.

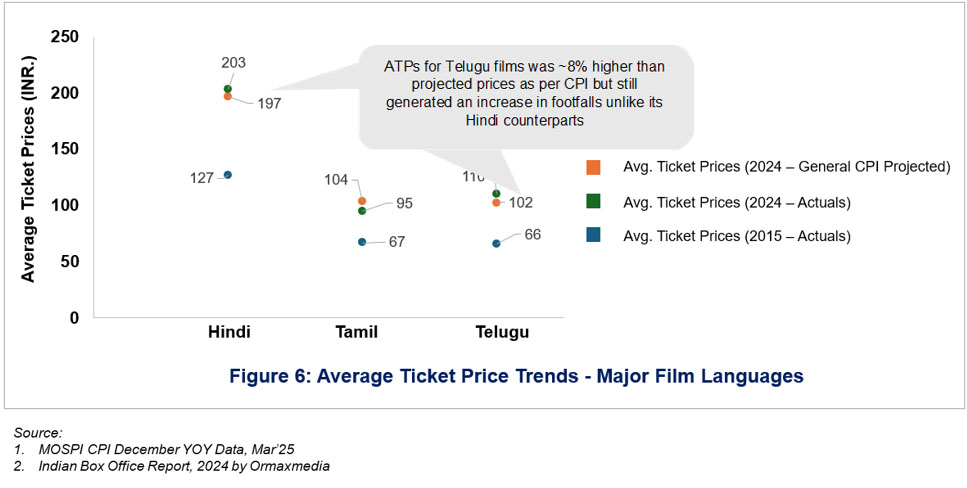

Accompanying the above trends, Hindi film theatre footfalls declined by ~25% (to 23 Crores) from 2015 to 2024, while non-Hindi film footfalls rose by ~10% (to 65 Crores), with Telugu films showing significant growth. While Hindi film Average Ticket Prices (ATPs) kept pace with consumer inflation, other language ATPs, except Telugu, were substantially lower, with Tamil films at INR 95 (~50% lesser than its Hindi Peers).

Stardom – May be, Story – A Definite Yes!

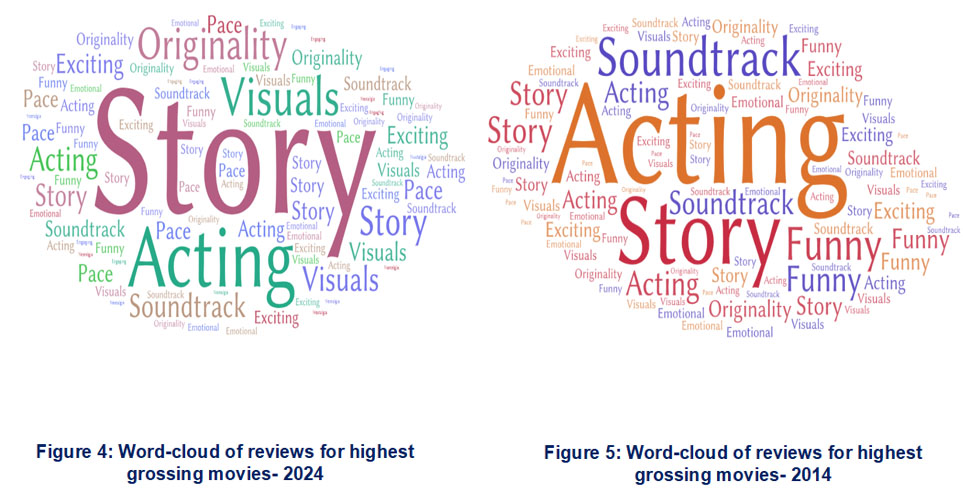

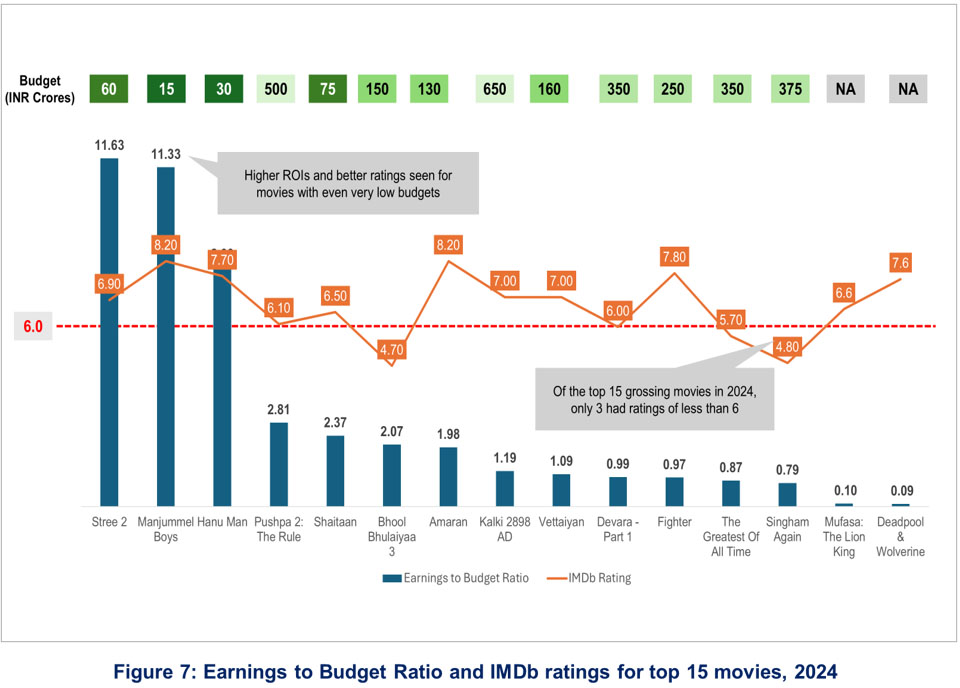

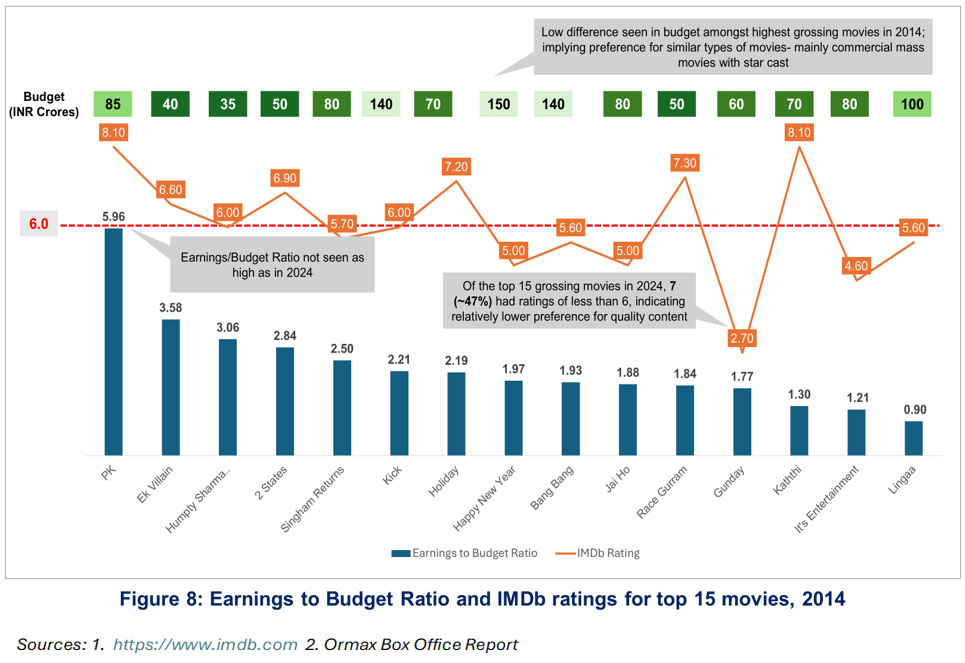

2024 saw unanticipated films with domestic box-office collections being manifolds as compared to their budgets: ~12X for Stree 2 and Manjummel Boys. Not only did these films do well commercially but also had a lower pre-release visibility through promotional campaigns than some of their high-profile peers. The average IMDb rating for top 15 films in 2024 was 6.72, higher than that of 6.03 for 2014. Analysis of reviews of these films highlight a clear pattern- the focus on an original and unique story, accompanied with solid acting, and stunning visuals. This is starkly different from 2014, wherein the focus of audience was on acting, driven by major stars. These preferences have been seen to precede film ticket prices for audience decision making and contribute towards footfalls. On the other hand, OTT players are accentuating access to the content viewers “want”, along with the convenience of multiple platforms.

Way-ahead: Shift of the Goalpost

With the trends and the audience preferences unfolding neatly, there are clear takeaways for the Indian film industry to thrive going forward:

- Content is the King: Filmmakers must prioritize strong content, as compelling storytelling, visuals, and screenplay collectively shape a cinematic spectacle. This highlights the growing importance of filmmaking crews, while reliance on star power alone offers limited impact.

- “Audience” Entry Strategy: With content at the forefront, filmmakers must carefully choose their entry strategy—either a big-bang launch with heavy promotions or a release through reputed film festivals, gaining critical reviews to generate word-of-mouth buzz. The right approach helps engage the target audience and minimize failure risks.

- Enhancing OTT Collaborations: Partnering with OTT platforms benefits content by combining filmmakers’ expertise with OTTs’ audience data. Such unconventional strategic partnerships can lead to more targeted, engaging, and potentially high-quality content, reaching wider audiences and mitigating production risks.

- Marketing – Out of the Box: A 2023 YouGov study shows ~64% of Indian audiences rely on post-release word-of-mouth. Agile, creative post-release campaigns using influencers and guerrilla marketing can boost box-office longevity, which will need a fundamental shift from fixed pre-release promotional budgets to post-release ones.

The Indian film industry is at an exciting turning point, driven by the convergence of languages, skills, and technology. Sustaining this transformation requires stakeholders to adapt to evolving audience needs. This ~2 million strong industry and the average Indian film-watcher appear ready to embrace this change.

Vigneshkumar Dhandapani

Vigneshkumar Dhandapani is an Associate Vice President at Avalon Consulting. He is a consulting professional with over 9 years of diverse experience in Go-to-Market Strategy, Performance Improvement, Manufacturing Excellence, and Change Management in diverse sectors such as heavy machinery, defense, and steel.