Ayush Patodia, Associate Vice President and Jatin Dang, Consultant at Avalon Consulting, co-authored an interesting piece titled, “How India can Navigate Geo Political Situation on Import Tariffs”.

The article explores how India can navigate the evolving global trade landscape following the U.S. decision to impose steep reciprocal tariffs. With India facing some of the highest tariff rates – around 50% in key export sectors such as textiles, engineering goods, chemicals, and electronics. The authors analyze the direct and indirect impact on India’s economy.

On April 2, 2025, what is marked as the Liberation Day in the USA, President Donald J. Trump unveiled a new trade policy, imposing a blanket 10% tariff on all imports and additional reciprocal tariff on 180 countries including India, which was among the hardest hit, facing retaliatory tariffs of 26–27 percent, which later raised to 50%.

The Trump administration justified the moved to impose reciprocal tariffs by arguing that the US had long been exploited by the foreign countries through unfair trade practices.

Impact of US Tariffs on India’s Economy

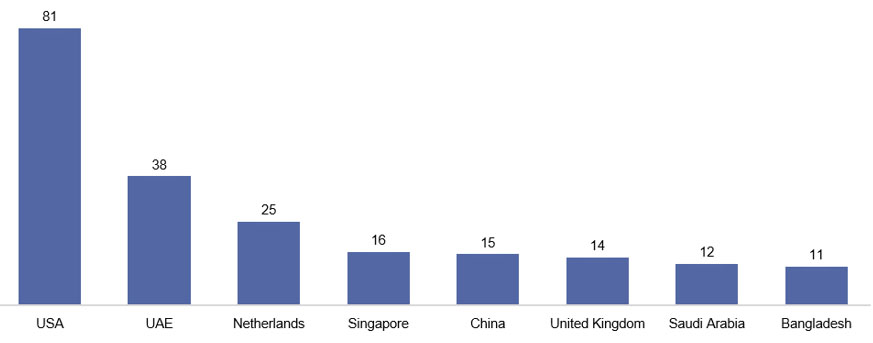

Break-up of India’s Exports by Country, 2024 (USD Bn)

Source: Trademap

In 2024, India exported $81 billion worth of goods to the US which accounted for 20% of the total exports, making it one of the key trading partners for India. By comparison, the UAE which is the second largest export market for India accounted for just 8%.

Engineering goods, Gems & Jewellery, Chemicals, Textiles and Electrical goods are among the key commodities exported, together they made up $53.1 billion, accounting for about 60% of the India’s total shipment to the US.

With tariffs raising the consumer prices the demand for the final goods is expected to shrink as these goods tend to be highly elastic and thus particularly sensitive to price changes.

There will also be an Indirect impact from supply chain disruptions, which will further amplify the overall impact of the tariffs.

A decline in India’s participation in the global value chains (GVC) could make it less attractive to foreign investors and is likely to deter investment in the export-oriented sectors

Sector-wise Implications

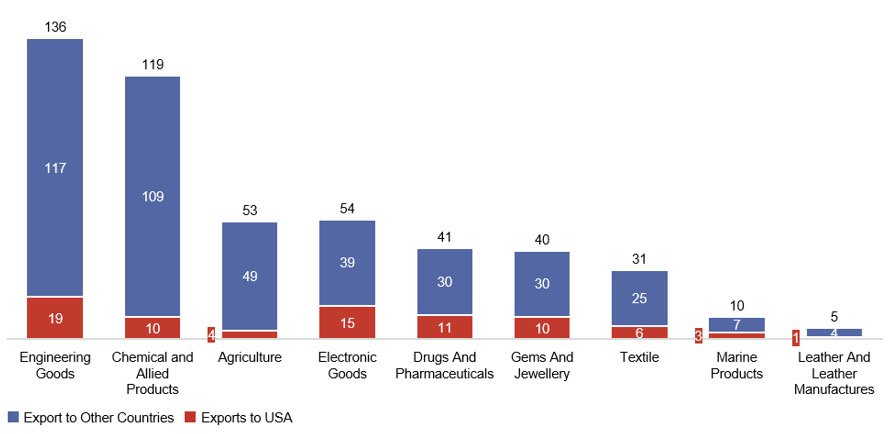

Sectoral Breakdown of India’s Exports to the US, 2024 (USD Bn)

Source: Trademap

India exported $116.5 billion worth of engineering goods in FY25, making up 27% of the total exports. The US was the largest market with a 16%, more than twice that of the second largest at just 7%.

Infact among India’s top 9 export sectors by value, the US is the largest market for 7 sectors which underscores how heavily Indian exporters are dependent on the American market.

Tariff Competitiveness Across Sectors and Alternate Suppliers

Textiles

| Textile | China | Special Case |

Vietnam | 20% | |

Bangladesh | 20% | |

India | 50% | |

Mexico (for non-apparel textiles) | 15% |

Source: PHDCCI Research Bureau Analysis

Chemicals: India primarily exports intermediate chemicals though much of this trade is in commoditized products with limited value addition

| Chemicals | Canada | 35% (if not USMCA-compliant) |

Saudi Arabia | 10% | |

Mexico | 25% (if not USMCA-compliant) | |

Iraq | 30% | |

India | 50% |

Electrical and Electronic Equipment: The sector remains heavily dependent on imported subcomponents, while Chinese manufacturers can absorb higher tariffs others are being squeezed between rising import costs and declining export competitiveness.

| Electrical & electronic equipment | China | Special Case |

Mexico | 15% | |

Malaysia | 19% | |

Vietnam | 20% | |

Japan | 15% | |

India | 50% |

Source: PHDCCI Research Bureau Analysis

Engineering Goods: The sector is strongly export-dependent on the U.S. and B2B buyers are expected to shift toward suppliers from FTA partner countries.

| Engineering goods | Germany | 15% |

Japan | 15% | |

China | Special Case | |

Italy | 15% | |

Mexico | 15% | |

India | 50% |

Source: PHDCCI Research Bureau Analysis

Article of Steel: In addition to reciprocal tariffs steel imports are also subject to Section 232 duties which can exceed 50%.

| Articles of steel | Canada | 15% |

Mexico | 15% | |

South Korea | 15% | |

Brazil | 10% | |

Germany | 15% | |

India | 50% |

Source: PHDCCI Research Bureau Analysis

Pharmaceutical Products: They are essential goods; their demand is inelastic and hardly changes with change in prices. The U.S. still depends heavily on India for these medicines and generic drugs are exempted from trade restrictions.

| Pharmaceuticals | Ireland | 35% |

Germany | 15% | |

Switzerland | 39% | |

India | Exempted for generics | |

Netherlands | 15% |

Source: PHDCCI Research Bureau Analysis

Indian Exporters can mitigate the impact of tariffs by:

- Diversifying exports market by redirecting trade volumes from the US towards the emerging markets and leveraging on the recently concluded free trade agreement (FTA) with the UK, advancing talks with the EU and the reviving negotiations with the GCC

- Prioritizing exports of value added and intermediate goods, particularly in areas where US demand is growing. These goods are generally subject to lower duties than finished goods, due to tariff-escalation patterns, which could help cushion the blow of tariff hikes

- Lowering the costs of raw materials especially in labour and resource intensive sectors such as apparel, chemicals and electronics. This can be achieved by sourcing raw materials locally, reducing production waste, improving energy efficiency, investing in R&D and process technology and developing shared facilities

At the policy level the Indian government can respond by:

- Negotiating product specific exemptions, by offering targeted deals such as zero for zero tariffs on steel and auto parts to shield the most vulnerable exports sectors. At the same time expanding production linked incentive could make India a more attractive destination for US manufacturers and bolster investment

- Strengthening India’s role as a China+1 alternative, to attract Asian importers particularly from Vietnam or Philippines, offering them a way to sidestep higher regional tariffs they currently face

- Shielding the robust services exports could help the country weather global trade tensions and prevent disruptions from spilling over into IT, GCCs and BPOs

India faces one of the highest tariff rates around 50% across multiple sectors which is likely to reduce demand for Indian goods in the US market. These products will become less competitive compared to domestically produced goods or imports from alternate suppliers such as Mexico, Bangladesh, and Vietnam. As a result, Indian exporters with significant exposure to the US will need to diversify their markets and focus on value added exports to maintain their global competitiveness