Vishal Dhikale, Associate Vice President, and Rajat Bansod, Senior Consultant at Avalon Consulting, shared their views on Sustainability in Indian Fashion: Differentiator or Mere Decoration?, which was published in MediaNews4u.

They highlighted that while sustainability has become a popular positioning tool for Indian fashion brands, much of it remains superficial, with widespread greenwashing and limited real change across supply chains. The article points out that despite rising consumer interest and market growth, affordability challenges, weak policy support, limited awareness, and fast fashion dominance continue to hold back genuine sustainability.

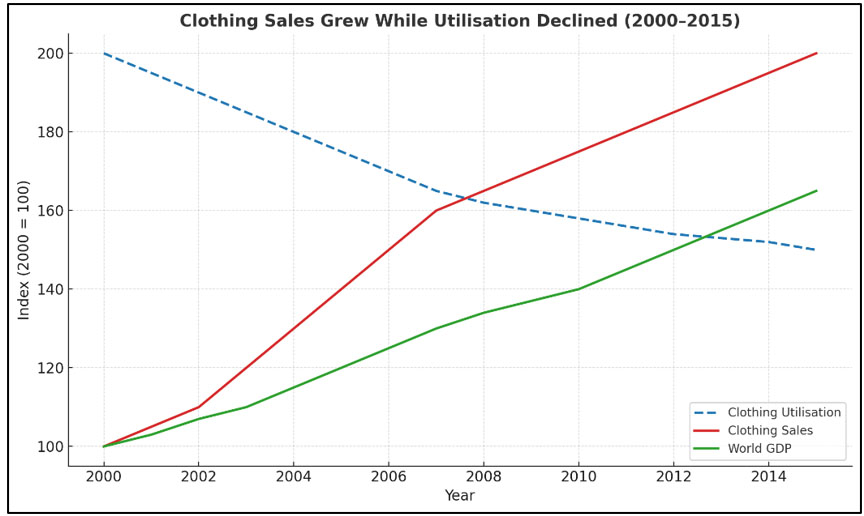

There was a drop of 36% in the clothing utilization during 2000-2015 across the globe. In spite of this, the global apparel production saw a drastic increase and almost doubled during the same period. These statistics indicate that the industry values rapid production and speed over sustainability. In India, a lot of brands are using the sustainability tag as a differentiator as fast fashion boom. Question raises whether its just green washing or brands are truly sustainable in the real sense.

Source: EllenMcArthur Foundation

India’s fashion industry is growing rapidly, fuelled by e-commerce, higher disposable incomes, and a young, trend-conscious consumer base. But this growth has a clear environmental downside. As concerns about impact rise, sustainability has turned into a buzzword, with brands increasingly using terms like organic and eco-friendly in their marketing.

Though there are sincere efforts, many are superficial. There is widespread greenwashing, as evidenced by the fact that nearly 60% of sustainability claims made by Indian fashion brands are either unsubstantiated or deceptive. Sustainability is being used more and more as a strategic tool as brands look to stand out, but it’s usually more of a marketing term than a fundamental change in business practices.

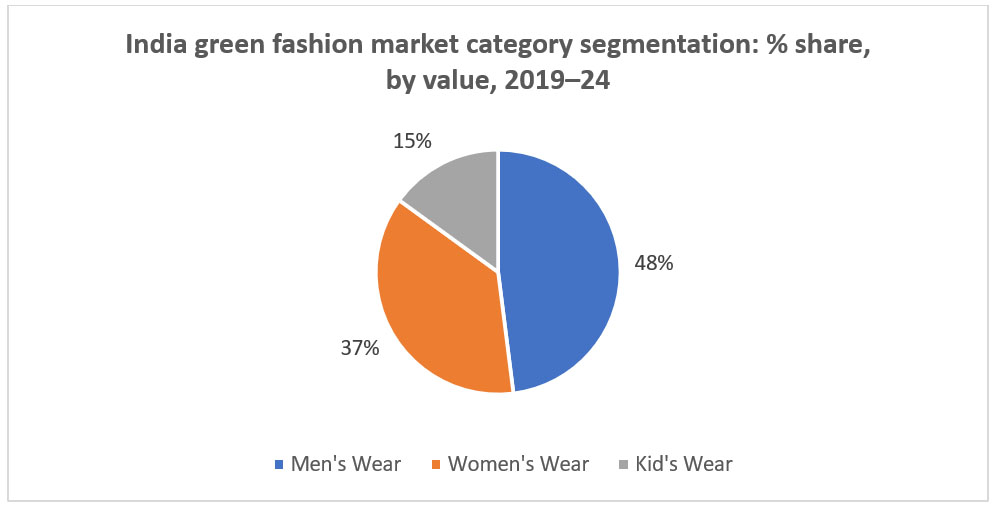

A microcosm of larger consumer and economic trends can be seen in the Indian green fashion market. The market grew 2.8% annually to reach $1,507.2 million in 2024. According to forecasts, the market will be worth $2,084.8 million by 2029, representing a compound growth of 38.3% and a growing demand from consumers for sustainable products (Source: Globaldata).

Source: GlobalData

One startling finding is that 47.8% of the green fashion market is made up of men’s clothing, defying the widely held belief that sustainability is a demand that is primarily driven by women. In the meantime, India’s growing influence is reflected in its 22.3% share of the Asia-Pacific green fashion market.

Source: GlobalData

The Issue with “Sustainable” Buzzwords

The definition of sustainability is one of the most difficult issues.

Many times, it is only focussed on less water usage and greener raw materials. This can be misleading as sustainability needs to be at a holistic level and should also cover long term impact on the environment, end of life issues, labour rights, fair wages and factory and worker conditions.

Even worse, a lot of companies release purportedly “sustainable collections” without altering the location or method of production. Just a different name for the same factories and methods. It’s greenwashing, not transformation.

By selectively focusing on what is considered sustainable, businesses give the appearance of accountability while carrying on with their destructive practices. In addition to confusing customers, it thwarts sincere attempts to change the sector.

What’s Holding Real Sustainability Back?

- Affordability challenges: There is usually a markup on sustainable apparel which may be a challenge for the average consumer. Brands do this because at every step there is an additional cost (For. Eg. using organic materials increases the production cost)

- Sourcing sustainable materials remains a major challenge. The supply of eco-friendly fabrics and inputs is still limited, and demand is growing much faster than what the current value chain can support.

- Government support is minimal: Policy support is a major miss. There are no major initiatives or incentives encouraging the industry to go green.

- Fast fashion still dominates the Indian market. Most consumers are drawn to low-cost, trendy clothes, and meeting this demand depends heavily on chemical-intensive production — with more than 8,000 different chemicals used across the value chain. This process is far from sustainable

- A 2020 survey revealed that almost half of Indian consumers had little to no understanding of what sustainable fashion actually means.

- Limited accessibility is another hurdle. Sustainable brands today cater to a small, urban niche, mainly because of high costs, limited infrastructure, and the lack of affordable alternatives for the wider population

So even with growing interest, these roadblocks prevent sustainable fashion from transforming into a truly mainstream phenomenon in India.

What Brands Aren’t Telling You

When sustainability is often talked about, it should not only be about materials—it’s the entire supply chain, which includes:

- Scope 1: Emissions from factories or transport

- Scope 2: Energy consumed (electricity or steam) from external sources

- Scope 3: Everything else i.e., how sourcing, packaging, and delivery happen etc.

Brands avoid talking about the scope 2 and 3 emissions. They do not mention details on the treatment of factory workers, sustainability of their sourcing methods and partners and the products end of life use case.

It is essential to address all the layers of sustainability to truly make a difference.

For instance, our research on one such aspect, sourcing, showed that almost 50% of the imports in India in the category of Apparel and clothing is coming from Bangladesh (Source: Trademap Chapter 61 and 62). The primary driver for this is the competitive edge in manufacturing costs. Bangladesh has lower labour costs compared to India.

Leading brands like H&M, Zara, and GAP source heavily from Bangladesh. Reliance Retail, one of India’s largest retail chains is also an example (Source: Fashionating World)

Bangladesh’s competitive edge is largely built on the availability of a large, relatively inexpensive workforce. Studies show that the lower production costs often come with a hidden price – poor working conditions. In Bangladesh, many garment workers face low wages, safety risks, and very limited labour protection.

Hence these kind of practices across the value chain are common and more often are kept under wraps to exploit benefits coming from introducing “Sustainability” in campaigns.

The Way Forward

There are glimmers of change. A few Indian brands now use QR codes to show how a garment was made or run clothing take-back programs to recycle old items.

But real change will need more than just a few good brands. A few initial steps could be

- Support from the government through tax breaks, incentives and better infrastructure for proliferation of sustainable value chain

- Build awareness through authentic campaigns on social media and in educational institutions, supported by responsible advertising that encourages mindful choice

- Introduce clearer rules and accountability around using words like sustainable, eco-friendly, and green, so these terms truly reflect responsible practices

For sustainability to truly matter, it needs to move beyond being a trend it should become part of how the fashion industry works every day, at every level.

References

(GlobalData, LocalCircles Consumer Survey 2023, reports from McKinsey & Co., Indian Apparel Export Promotion Council, Business of Fashion sustainability index, and government sustainability guidelines.)