Gaurav Joshi, Consultant at Avalon Consulting, shared his insights on “Circular Economy in the Energy Sector (Focusing on Indian Energy Sector)” submitted as part of Cordence Worldwide’s “The Insight Initiative,” a global blog and position paper competition for young consultants in the YPN network.

He highlights the need to design energy systems for reuse, recovery, and minimal waste across solar, batteries, bioenergy, and industry. He points to India’s policy push through EPR, SATAT, and PAT, while noting gaps in implementation and recycling capacity. He emphasizes that stronger enforcement, incentives, and industry action can make circular models a key driver of India’s energy security and sustainability.

When we hear the term “Circular Economy,” what comes to our mind? Terms like optimal resource use, minimal or zero waste, and the classic Three Rs—Reduce, Reuse, Recycle.

Energy systems across largely rely on finite resources—most notably fossil fuels. Historical events like the OPEC oil embargo remind us of the volatility of supply and how high is our dependency on Fossil Fuel for Energy. Though, even renewable sources (solar, wind, hydro, nuclear) depend on limited materials (e.g., silicon for solar panels, rare earths for wind turbines). That is why the concept of Circular Economy is not limited to Fossil Fuels. It is important every source of Energy as when applied to energy, the concept spans over the entire lifecycle—from resource extraction to final disposal. For example, consider a solar panel: its value persists efficiently if recyclability is embedded in its design—so that silicon and other materials can be recovered and reintroduced into the production loop.

The concept of circularity has gained traction post strong sustainability efforts, especially following the 2015 Paris Agreement where the importance of mitigating climate change was identified due to rising global temperature. The energy sector faces its unique challenges: rising CO₂ emissions due to increase usage of combustible fuels, overwhelming reliance on fossil fuels, geopolitical tensions for mineral & energy, and energy security concerns which makes circular models so important globally.

Investments in the low-carbon energy transition exceeded USD 2 trillion for the first time in 2024, reaching about USD 2.1 trillion. According to the IEA in 2025, around USD 2.2 trillion is projected to flow into clean energy technologies—double the investments going into fossil fuels—with total energy investment reaching USD 3.3 trillion. Despite this progress, to stay on a net-zero trajectory, annual investment must rise significantly—to an average of USD 5.6 trillion between 2025 and 2030.

India’s Perspective:

India just reached the landmark of 50% of its installed electricity capacity from non-fossil fuel sources this year—five years ahead of the target set under its Nationally Determined Contributions (NDCs) to the Paris Agreement. Renewable Energy Sources contribute up to 38 % in the total Energy Capacity.

Policy Changes are the core of such structural changes in the economy. In India since last 3 years, Government is focusing on Extended Producer Responsibility (EPR) so that the vision of circulation drills down to every producer & consumer and adaptation of Circularity can be implemented for Optimal Usage of Finite Resources.

Battery waste Management Rules which focus on Usage of Recycled Content in New Batteries is implemented through EPR. E-Waste Management Rules for solar PV modules, panels, and cells are also added to EPR, obligating manufacturers to store, track, and ensure compliant recycling to close the waste stream. The guidelines are designed by Central Pollution Control board on PV waste is stored, handled, and transported, and push producers to set up take-back systems.

On the low-carbon fuels front, circularity is embedded in bioenergy: the Scheme on Compressed Biogas (SATAT) program catalyses compressed biogas (CBG) production from Agri residues, press-mud and sold to oil marketing companies via offtake. A complementary Biomass Aggregation Machinery scheme tackles the biggest bottleneck—feedstock logistics. Meanwhile, ethanol blending and biodiesel from used cooking oil keep waste-to-energy loops running through the transport system.

Along with the policy, Strong & standard Guidelines should be made for organizations: translating circular principles into action. We have these guidelines for OEMs focusing in Design Sensitivity (Engineer for Disassembly) to process smooth Disassembly while Reuse/ Recycling. This will reduce recovery cost & increase efficiency. Organizations are also guided to Establish Strong Take-back networks of batteries. For Fuels, Refineries/OMCs & city gas operators are advised to co-invest in Compressed Bio-gas clusters near feedstock hubs to derisk projects and integrate digestate as a bio-fertilizer revenue stream.

Just mandating these changes will not result in adaptation, therefore Incentivising/ Penalising system are important. Energy-intensive facilities should benchmark SEC (specific energy consumption), participate in Perform, Achieve & Trade (PAT) cycles, and use Monitoring, Reporting & Verification systems that stand up to Bureau of Energy Efficiency (BEE) standards which will help turning savings into tradable certificates and capex into cash flow. There are also norms where if Solar developers will include EPR compliance costs in the financial model; pre-contract with authorized recyclers; and design to minimize breakage (field repair kits, safe handling SOPs as per CPCB), it will severely increase efficiency in usage & recycling.

The Major Gap lies in Implementation. Circular policy doesn’t implement itself. Investigations in 2024–25 by The Guardian show a compliance gap in handling solar waste, with leakage to informal handlers and inadequate authorized recycling capacity. That’s precisely what the 2025 CPCB draft guidelines aim to fix, but success will depend on enforcement, producer cooperatives for take-back, and better economics for recovery of glass, aluminium, and silver.

On batteries, EPR will push formal collection and higher recovery rates, yet the ecosystem needs scalable reverse logistics, standardized testing for second-life safety. The policy already seeds the right incentives and firms that move early can lock in cost and compliance advantages.

The road ahead:

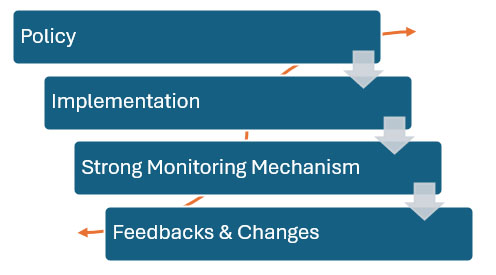

India’s clean-energy build-out is now unquestionably underway; hitting 50% non-fossil capacity ahead of time proves it. The next step is to make that system material-smart—where every panel, battery, and bulb is traced, recovered, and cycled back into production following Circular Economy to ensure Optimal Usage of Resources contributing to Climate Change targets through these Sustainable practices. With EPR for Solar (PV) and batteries, SATAT for bioenergy, PAT and UJALA for efficiency, the policy is largely in place. The opportunity (and responsibility) now shifts to companies and utilities: design products for disassembly, set up take-back and authorized recycling, buy circular fuels, and track efficiency as a balance-sheet asset. But monitoring mechanism, Incentivising/ Penalising Mechanism have to be more effective for this positive change to happen, yet along with these challenges, it provides several opportunities for the Public & Private sector.

Gaurav Joshi

Gaurav Joshi is a Consultant at Avalon Consulting. He has completed his BTech in Agricultural Engineering from GBPUAT Pantnagar & PGDM in Rural Management from IRMA. He has 2 years of diverse experience where he has worked as a Development Professional in an NGO, Product Manager under Agri Portfolio in a bank and currently working as a consultant in an Agribusiness Project.