In Predictions 2026: Uncertainty and a Bit-Conned World, Raj Nair presents his 19th annual global outlook, examining the economic, geopolitical, technological, and social forces shaping the year ahead. While the world economy has shown resilience despite trade tensions, tariffs, wars, and policy shocks, 2026 is set to be marked by heightened fragmentation, rising uncertainty, and declining trust—both in institutions and in everyday life.

The paper analyses key themes including global growth prospects, US trade and tariff policies, the evolving role of the US dollar, the rise of non-USD trade mechanisms, cryptocurrencies, and capital flows across emerging and developed markets. It also explores sectoral opportunities in areas such as AI infrastructure, defence, energy, metals, and financial services, alongside risks from geopolitical conflict and climate change.

Beyond economics, the note highlights a deeper challenge: the growing anxiety and loss of social capital in societies worldwide, amplified by rapid technological change and disconnection from the physical world. The paper concludes with practical reflections on how individuals and organisations can navigate uncertainty without being “bit-conned” by speculation, misinformation, or false promises.

This perspective is essential reading for business leaders, investors, policymakers, and professionals seeking clarity—and balance—in an increasingly unpredictable world.

The festivities of Christmas and New Year are fast approaching as I sit down to complete my predictions for 2026. Since 2025 was a complex year, as will 2026 be, I will intentionally focus on only a few key aspects. The global GDP growth in 2025 is likely to be around 3.0 to 3.2%, as expected in my paper a year ago, and the growth in 2026 seems likely to be just a shade lower at around 2.8 to 3.1% (without the benefit of front-loading of supply before the Tariffs kicked in, in 2025). The global economy did not sink in spite of political and trade turbulence, but it is likely to splinter. Additionally, I see increased uncertainty, anxiety, and stress in society – in newspapers, on TV, and in questions that young people pose to this grey-haired man. It’s not just some well-known politicians who are ruining the festive season. I have also been having a gnawing feeling for the past few years that there is a certain degree of stress in society that did not exist before. Some technologies have played a pivotal role in this because they disconnect people from the physical world, thus reducing their ability to deal with real issues. I requested one of my closest friends, a person whom all respect, to suggest the most important topic about which I should write. Pat came the answer: Uncertainty. Since uncertainty is a challenge even for connected people to deal with, it would be a bigger challenge for the disconnected. Modern society has contributed to it – the rich and not-so-rich, the powerful and the not-so- powerful, conmen and those who don’t look the part. Hence, nearly half of my paper will focus on issues that are going to increase uncertainty, as well as a bit of what we can do about it. But all that only after a quick review of a few global issues.

It is but natural to start with Tariffs to explain the underlying game. It is fair to acknowledge that Trump understands that America got weakened over the years by sacrificing basic manufacturing and services capabilities at the altar of cost saving. Jack Welch led America down that path. It is not merely random sabre rattling by the POTUS. The Tariff regime is based on clever plans created by Trump’s advisors to address the problem of funding tax cuts for the rich while simultaneously pandering to Trump’s simplistic economic theory on trade, which can be explained in one word – mercantile. In a balanced mercantile relationship, two parties must have no trade imbalance between them. Since the US has a trade deficit with most countries, his Administration probably produced a solution that combined high tariffs with forced opening of global markets to imports from the US. The way high tariff works is that it can make imports into the US more expensive and thus the US demand for imported goods and the US Dollar (USD) fall. Consequently, the USD could weaken. But the unsuspecting citizens pay for this (not exporting countries). Once the USD’s value drops, it provides room for some cost relief by calibrated reduction in Tariffs.

I recently thought about my conversation at lunch in October 2024 with a leading Silicon Valley VC who is a huge supporter of Elon Musk, Peter Thiel, and Trump. He urged me to buy a lot of Bitcoin immediately and get out of USD. Weakening the USD and strengthening Bitcoin was part of a bigger strategy. When the US Government created a Strategic Bitcoin Reserve in early 2025, it signalled to the world that the US Government doesn’t rely solely on the USD to store value. This has eaten into the sole safe haven status of the USD. When inves tors acted on this cue, and started investing in Bitcoin, it was natural to expect the USD’s exchange value to soften. That would h elp to pare USA’s dollar denominated debt to the world at large. The USD liability on its Balance Sheet is too huge repay and the interest cost to service the debt had already climbed to 15% of the annual revenue. However, the USD has only dropped marginally from its peak on Jan 10, 2025, till Dec 20, 2025 (less than 1% against most currencies) though bond yields soared and the stock market took a beating just after Liberation Day. The strategy has not yet worked. In 2026, the USD will remain the dominant currency but will lose some of its Safe Haven shine. The Dollar Index is expected to fall by at most 3 to 5% during 2026. Thus far, the World has not yet taken a haircut on their USD Assets.

Tariffs were also a way to get funding from the US citizens at zero interest cost while pretending that the World is paying for it. The upshot of all these strategies is that clever people in the Administration have given Trump a Sten gun called Tariff with which he is free to shoot at any country of his choice and to whatever extent he pleases. Boy, doesn’t he love it! Hence, his urge to ‘Control the Whole World’. Actions to stop wars, start wars and bring about regime change in some countries like Iran and Venezuela (very strong candidates) could only increase in 2026.

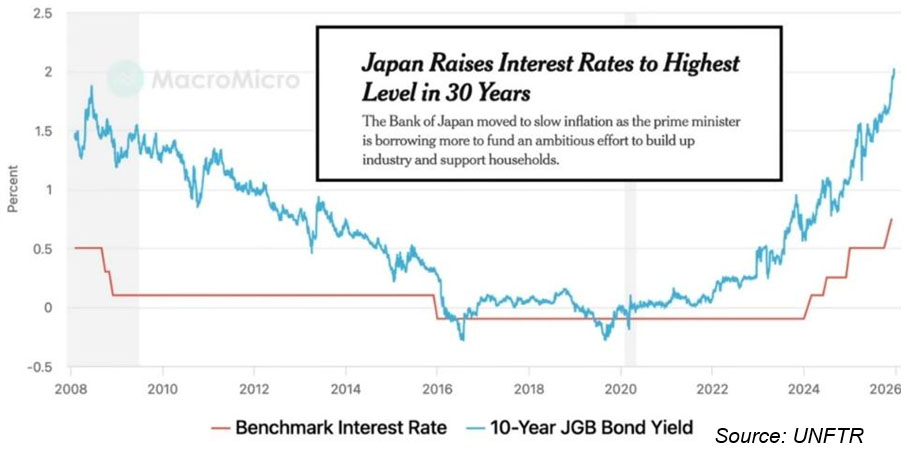

It is not prudent for large holders of US Debt to suddenly offload large amounts because it can damage the value of the remnant debt assets that they hold. Therefore, big holders of US debt will tread slowly as they have been gradually selling off their USD based assets in defence of their own currencies over the past few years. China sold USD 20 billion worth in the past year to rebalance their reserves. US Debt sell-off in 2025, was partly because Yen Carry Trade has become risky with Japan increasing its interest rates, triggering exit from US Treasury to buy Yen. It is worth noting that this has implications on global liquidity float, well beyond the US shores. The Bank of Japan has resisted external political pressure and raised interest rates sharply since 2024 to the highest in 30 years to manage inflation (See chart 1 below).

Chart 1: 30 year Japanese Interest rate trend

In 2026, one can see three camps emerging from the trade tensions and the heavy handedness of the US Administration in 2025. The US Camp (Anglophile countries and the EU) and the Russia-China Camp (including countries opposed to the US) at the two ends, with Neutrals (UAE, Saudi, India, Malaysia, Indonesia, Vietnam, Thailand, etc.) in the middle who are not anti-USD but are Pro-diversification. While USD and SWIFT will continue to dominate, non-USD based trade is likely to increase from 10-12% to nearly 14-16% in 2026 because some of the following multiple formats were still under trial for testing the technology in 2025:

Bilateral trade:

- Russia-China in Roubles and Yuan

- Russia-India in Rupees, UAE Dirhams, and Yuan

- UAE-China in UAE Dirhams and Yuan

- Brazil-China in Reals and Yuan

Alternative platform to SWIFT being trialled/ just implemented.

- BRICS Pay/ Bridge

- Russian SPSS

- m-Bridge (China, UAE, Thailand, Saudi Arabia)

- Chinese CIPS (190 direct Institutional participants plus 1500+ indirect participants in 120 countries. They

include a few International Banks like HSBC, Standard Chartered, Deutsche Bank, and JPMorgan in Europe.

Barter Trade

- Iran with Pakistan, Sri Lanka, China and probably Russia

- Russia with China

Non-USD Trade settlements jumped after seizure of Russian financial assets in 2022. It is another matter that Scott Bessent and his team, have been visiting various countries around the World including Canada, Japan, India, China, and attending the G7 Meeting flaunting a carrot and stick to keep the flock in check. SWIFT. The blunt message to the Pro-Diversifiers is – ‘No selling US Debt, no by-passing the USD in trade deals, align with the America First philosophy ….or else. Be with us, and you get deals.’ They know what will happen to the US, when the USD is largely bypassed.

No discussion on money and wealth will be complete without discussing Cryptocurrencies. They are neither money nor wealth. Their share in the global money supply (M2) in 2025 was only 2.2% out of a total of USD 130 trillion and of the global wealth barely 0.6%. But cryptos share of money supply is expected to rise to 3.5 to 4% in 2026 because USA and some minor countries have added cryptos to their strategic reserve, MFs in the US are likely to allot a share of some investments to cryptos after having tested them in 2025, and because cryptos like Bitcoin, will reach the end of their 4 yr halving cycle in 2026 making them more stable. What is worrisome is that 7% of the global populations own Crypto owners and much more in certain countries like Nigeria 47% (guess why), UAE 25% (mostly the rich boys), Vietnam 20% (youth), etc. The Trump family has also reportedly cashed in on Bitcoins through DiFi (World Liberty Financial), Stable Coins ($USD1), Bitcoin Mining, etc. to make realised and unrealised profits estimated variously at between USD 2.7 to 3.3 billion in under one year – all apparently legally. The returns on such investments are so good ven the ‘upright’ Government and Military Establishment’ of Pakistan sought and got an opportunity to invest serious money in these operations. Bit-Conned but who?

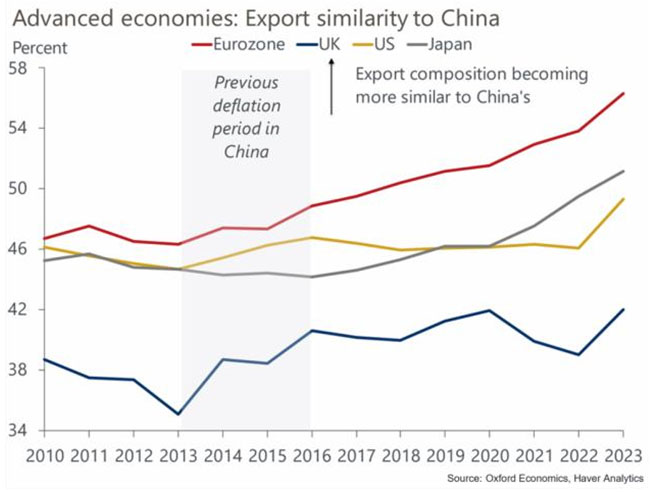

The US economy would have grown by 2% by the time the sun sets on 2025, the EU by 1.4 %, the UK by 1.3%, Japan by 1.1 % and China by 4.8%. The global economy did not go belly up, Trump threatens big at first as a negotiating tactic and then strikes deals at much lower levels. That gave some countries a few months to create an emergency plan for partial realignment. A longer-term diversification of trade is to be expected over the next three years. One camp where his bluster has had no impact is in the ‘Communist’ bloc of Russia, China, and North Korea. Non-enemies were singled out for severe tariffs and abuse, like the North American allies, Brazil (the Bolsonaro factor) and India (reasons explained below). India’s trade negotiations with the US administration have probably got stretched out (almost failed), while other countries could sort out issues quickly for a reason. For Trump’s advisors, it probably goes back to the lessons learnt from molly-coddling a low income, low tech and ever eager China which possessed very modest military power, for over four decades as a counterweight to keep Russia at bay. In 1978, Russia was not exactly friendly with China. Since 2018, China has been seen as an economic threat to the US. The following Chart from Oxford Economics/ Haver Analytics shows that from 2016 the overlap of China’s exports with goods similar to those being exported from the US, UK and the EU has shot up to ~50%. This is especially so in hi-tech areas like EVs (and automobiles in general), batteries, Solar cells and panels, AI, Railways, Defence technologies, etc. (See Chart 2 below)

Chart 2: Exports from China, USA, UK and EU now overlap

China is an economic and military threat to US dominance. Even Russia has become subservient to it. Clearly China’s march to the top place in manufacturing, AI and digital technologies, enviable infrastructure, and military power. is unstoppable. Hence, India was being developed as a counterweight to China by many previous POTUS because of its poor relationship with China for over six decades. But India is a problem because it does not to be a vassal State to any other country and has defied Western ‘guidance’ that it should not buy oil from Russia. India’s economic resilience when under pressure despite being a low per capita income country, and frequent (and often silly) announcements that it will soon be the third largest economy, reminds the current US administration of the mistake it made in using China as counterweight to Russia. The relationship will improve but I don’t see India being a specially favoured nation for the US in 2026 despite the strong mutual affinity at the people-to-people level.

While Brazil seems to have taken a hit (2.2% growth rate in 2025 and likely lower in 2026), India’s GDP growth rate will still be around 7.0-7.2 % in 2025 (despite some exporting sectors suffering body blows), mainly because low oil prices helped to moderate inflation and because exports to USA don’t affect the largely domestic led economy too much. While India’s Nominal GDP growth held steady in 2025, the high Real GDP growth rate was due to exceptionally low inflation. Some countries like the BRICS (which now include Egypt, the UAE, etc.) have started striking some trade deals without using the USD. Whether this would accelerate further would depend upon the US Administration’s policy to restore trust in the US as a strategic partner. Several countries, including Canada, which were dependent on the US market, have taken decisive steps to diversify their trade. This, despite the US remaining the most attractive market by size and diversity of demand.

2026 will likely see the global economy being calmed because Central Banks will follow a policy of neutral/ stabilisation interest rate, while some Governments will provide liquidity for growth. But Japan’s bias towards raising interest rates will hurt global carry trade, leading to a decline in both carry-trade activity as well as the cash surplus sloshing around in global markets. In some countries like the US, asset purchases by mid-2026, could ease liquidity. Inflation will not be a worry for global central banks, with the FED, the Bank of England, and the ECB willing to live with close to but slightly higher than target inflation of 2%, PBOC (China) expecting 1.5% and BOJ likely to hit it’s 2% target. Surprises come when one is overconfident that nothing will go wrong. e.g., In the UK, a temporary air pocket is possible because politics is messed up, deficits are high, and borrowings/ GDP is nearly 1, while farm tensions are high due to some tax ‘reforms’. The Bank of England has actually cautioned about this in its December 2025 Report.

Even the stable France faces ‘fragility risk’ which could send its bond market into a temporary tizzy if the Government is not able to push through its policies. That said, Mexico and Türkiye are more vulnerable to shocks than the UK and France. Fund flows are expected to shift toward select emerging markets and away from US-centric assets because of uncertainty around US policies but some emerging markets remain fragile as they have to refinance IMF loans taken at very low interest rates during the pandemic. The most likely EMs to benefit from global funds flow are India, Vietnam, Malaysia, Thailand, Indonesia, S Korea, etc. whilst Japan will be a defensive play. China, Saudi Arabia, Egypt, Mexico, Brazil, etc. could be selective plays. Equity Funds will find certain sectors like Infrastructure (especially AI related like those who sold pickaxes and shovels made good money during the Gold Rush ), Defence and Financials, globally attractive in 2026. This will be applicable to India, Japan and the ME as well, but there will be regional variations. The ME will also see opportunities in tourism and logistics, whereas the Nikkei is likely to be lifted by the Japanese Government’s push to make companies unload their cash stockpile as dividends, and buybacks. Growth and M&A activity could also pick up, while in-sourcing of manufacturing in the US could provide some specific opportunities. The attraction of the EU lies in the lower P/E ratio vis-a-vis the US market.

Not surprisingly therefore, metals are entering an upcycle. Gold, Silver, Platinum and Palladium are seeing rising demand but stagnant supply. Gold’s rising demand is linked its usefulness as a hedge against the declining USD. AI driven power sector growth is pushing up demand for Silver and Platinum. Aluminium, as a cheaper substitute for Copper in the power sector is likely to see an uptick in demand. Nickel prices could jump by 30-40% in 2026 from the lows of 2025 if Indonesia restricts supply. Steel prices are likely to only rise marginally because the surge in Indian demand might get offset by a fall in China. Indian manufacturers of primary steel will get iron ore cheaper in 2026 because a huge new source of very rich iron ore (65+% Fe) is opening up in Simandou, Guinea.

Given the co-ordinated Naval, Army and Airforce blockade since mid-December, intervention in Venezuela is a certainty, only the modality and timing remain uncertain. Action with less collateral damage to oil installations can be expected because the objective seems to be, less to punish Venezuela for drug trafficking and more to help US oil companies. Trump needs low oil prices for Nov elections and to punish Russia. OPEC is likely to fight to retain market share. Hence, oil prices could remain mostly in the sixties, at times even lower, in 2026. It may remain a bit volatile (with upper bounds at about $70 for Brent crude) despite oil surplus, due to USA’s unfinished agenda with Iran, and the continuing strife with Houthis (which risks temporary closure of the Suez Canal if they choose to strike back in desperation due to Iran’s declining ability to arm them adequately).

China would be very unhappy if Trump messes around in Latin America where China’s influence and investments have been increasing, but in Asia and Africa, China will gain from the slowing down of US efforts in those regions (economically and militarily). Taiwan may get dumped by US when push comes to shove. The war in Ukraine continues to give hope of closure in fits and starts, but it will take huge concessions from the West and Ukraine to get Russia to stop the war. Ukraine can ill afford to keep fighting and the Russian economy needs the war to stop, but Putin keeps harping on some of Russia’s conditions precedent given that Russia has now got the upper hand militarily. The US and the EU are scared to call Russia’s nuclear bluff and to physically join a counterattack by Ukraine this winter. Not halting NATO’s creeping Eastwards expansion and, the move to use Russia’s frozen financial assets to fund the reconstruction of Ukraine are serious red flags for Russia. While the end of the conflict is not in sight, the situation could change rapidly if Trump agrees to concede to Putin’s demands and pushes Ukraine to compromise with Russia. He may be inclined to do it if he can extract some value from both.

The big winners on the 2026 GDP growth scoreboard (above 6%) could be India, Philippines, Vietnam, Guyana, Rwanda, Ethiopia, and the slow coaches in 2026 could be the UK, Germany, Canada, Italy, and Japan (its ok as these countries already have a high per capita GDP).

The biggest losses in 2025 have been ‘hope and trust’ at the individual level and not just in politics and the economy. Social Capital (trust, bonding, and tolerance between people) has dropped in 2025 not only in the US but in many parts of the world. It is hard to imagine that it will improve alongside economic growth. Merely thinking about the future in economic terms but living in complete uncertainty does not help. A person who lives in anxiety every day cannot be expected to feel consoled at the end of a year that he survived. While looking at all kinds of uncertainties that are bothering people of the world, I came across an interesting analysis by Ipsos. (See Chart 3 below):

Chart 3: Anglosphere is Nervous; Asia is excited about 2026

It plots countries by the degree of excitement about the future against the extent of nervousness. The Anglosphere comprising of the UK, USA, Australia, New Zealand, Ireland, and Canada seems to be least excited and most nervous about the future, whereas Europe is low in excitement but less nervous about the future. I wonder whether the better social safety net in many European countries has contributed. By contrast, Asia is middling in nervousness but excited about the future. These are fast growing economies with a younger population. Japan is the least nervous of all and seems to be not too excited about the future. It is my surmise that greater the uncertainty and lesser the hope in a society, there will be nervousness, and that lesser the uncertainty and higher the hope, there will be excitement about the future. I have presented below only a few issues that make people nervous due to uncertainty, to make one key point:

Will I lose my job and remain unemployed for long due to the rise of AI?

AI will not take away your job in 2026 any more than in 2025. People with acquired skills to use AI will likely replace those without. Though no mass unemployment is expected in any country despite 2026 being the first full year when the impact of Agentic AI will be felt, a change in unemployment pattern may happen. Today, unemployment of youth is very high compared with that for those above age 35. This might reverse in the interim due to AI.

AI cannot significantly replace humans till it understands SDAO (State of the World) context, the Dynamic changes the world goes through partly through human agency (action-reaction), the limits of Actions that are possible due to certain real-life constraints some of which are not quantifiable, and likely Outcomes of those actions and how they deliver on the objectives/ goals Work will tend to become Human in the Loop. Certain jobs are rather vulnerable (routine clerical work, basic accounting, contact center agents, basic coding/testing, non-critical translation, etc. which are rule based) and some jobs will remain very safe despite the march of AI (those requiring judgement, special human skills, creativity, and other kinds of work which require a human touch like teaching, trades [like plumbing, electrician, erection crews, etc.], healthcare profession [like doctors, nurses, physiotherapists, ward boys, etc.], creative work for design, advertising, movie making, marketing, theatre, etc., strategy consultants, managers whose role is to not just co-ordinate but to manage and motivate humans to obtain business outcomes, business leaders, entrepreneurs, sales involving judgement, negotiation and relationship building skills, etc.). Irrespective of which category your job is in, it’s better to get trained to gain operating AI skills instead of worrying about a layoff notice because most jobs in the future will require AI and humans working together in sync.

Will my savings be lost in a stock market crash due the bursting of the AI bubble in 2026?

AI is here to stay and grow rapidly as a technology. The AI bubble builds up when valuations go sky high in a mad frenzy amongst many developers and investors are in a race in which only a few will win and the majority will fall by the wayside. If the flow of the stream of losers is slow and gradual, there will be no bubble burst. But that’s not how these things will happen if investors go far ahead of themselves. In an AI bubble burst, the losers will be institutional investors and less likely to be individuals because many of these companies have not yet had an IPO. Though there surely will be losers in 2026, it is neither likely to be a sudden bubble burst (that can happen in later years), nor will it impede the progress of AI. This is the courtship period when qualified investors are dating and gifting to win the hearts of Foundational AI companies. The romance is expensive. If it does not work out, a lot of money will go down the drain.

ere are AI infrastructure companies making Data Centers with P/E multiples in the 20s (barring a couple above 50X), those making advanced GPU chips with ratios between 50 to 75X (barring a few exceptions below and above that range). Then there are companies that help others implement AI systems. Palantir is standout success in that arena. However, its P/E multiple in excess of 400X is worrisome. Any sensible investor knows that if the P/E ratio for a stock is in excess of 50-75, it is risky no matter how high, the expected growth rate of the underlying business is. If it is above 100, you are taking a huge chance whether it is a company in AI or in any other sector unless there is a huge moat. Palantir could still emerge as a brilliant winner, but these valuations are not for the faint hearted.

The bigger danger in 2026 is being cheated out of one’s wealth by rogue AI apps which are essentially fraudulent or falsely mimic well-known Apps. e.g., DRWAI (fake trading service), MTI (a fake crypto trading platform), Clones of known brands like Zerodha Kite Replicate, etc. Beware of baits offering quick and easy high returns. In any case, caution is the best preventive.

Will interest rates rise due to the volatile global political situation and hurt my ability to borrow and repay loans?

Will I lose my home to foreclosure? No. Interest rates are likely to stay put or drop in most countries except in a few like Argentina, Türkiye, Iran, Sudan, South Sudan, Zimbabwe with high inflation. Brazil, South Africa, and Russia may wait and watch before taking a call to drop interest rates in 2026. Interest rate may actually drop in developed economies but cautiously in measured steps (USA, UK, EU, Canada, Australia, etc.) and China. In India, interest rates may drop further in February 2026, as long as inflation continues to remain benign. The RBI is likely to increase money supply to prevent the Government of India’s funding needs from crowding out the private sector. So, borrowing may not be a problem for anyone in India with a good credit score.

Will high inflation erode my consumption budget?

Largely No, but in some countries Yes, as explained above, though it will not be a surprise for people in those countries. The US may see some delayed inflation in 2026 due to Tariffs which could hurt the US population. Thankfully, it may not be much because imports (goods + services) impact merely 14% of the GDP.

Will I be able to procure my family’s basic needs like fuel, food grain, healthcare, etc because of the reset in Trade Policies (tariffs and subsidies), war, and other conflicts?

Yes, in most parts of the world but how to manage that is going to be different in 2026.

Will climate change devastate life for those who can little afford in 2026?

Floods, drought, cloud bursts, rising water levels, wildfires, more frequent typhoons, and tornadoes will hurt people and countries, which can least afford them. 2026 threatens to be a bad year for the Global South because the impact of rising climate change related problems will reduce the ability of many nations to recover from the previous disasters. The ‘recovery gap’ (time to recover between two catastrophes) will drop sharply especially for economically disadvantaged sections of society. The Caribbean, Florida, East Africa, the Philippines, and Vietnam in particular will face the brunt of powerful storms.

Cooler atmosphere due to El Nina is not going to make life any easier in 2026 for coastal cities in SE Asia (especially Manila, Jakarta, etc.) and in South Asia (Maldives, Singapore, and Bangladesh) where high tide levels are expected to rise. Glacial melting will raise sea levels by 4.5 cm per year across the world.

The deeper I dug, the more I realised that merely being able to predict the future scenario as above, does not solve the problem. The key point is that anxiety is caused not by uncertainty per se but by the consequent loss of control over our lives. Kahlil Gibran said that “Our anxiety does not come from thinking about the future, but from wanting to control it.” It took a few drafts of predictions on uncertainty over six weeks, till I finally understood what Kahlil Gibran actually meant. Predictions to reduce uncertainty alone will not solve the anxiety problem. It will take more than that. A mind detached from the body cannot get the agency required to exercise control.

We have reduced physical human-to-human interaction due to new technologies; we have far too many options without adequate information to make choices which often have to be made faster than ever before; we have high personal expectations in a troubled or slow job market, etc. These are collectively resulting in anxiety. That coupled loneliness can even lead to depression. Additionally, right from the start of 2025, the world has become very uncertain and a far less peaceful place for young, educated people; even worse, for those without education and new digital skills.

Since recommending solutions to such problems is not within my area of expertise, I did some research which I present below in brief, with the hope that some readers with expertise, will dig deeper to offer practical solutions to the world at large.

Most of the world is still a safe place despite the turbulence that we can feel. This is a transitionary phase when technology has magnified the mismatch between how humans have gradually evolved and how modern life has now been restructured. There is more change on the way because AI research is making rapid strides, but the good news is that things will evolve to a point where man and machine will work in unison as a unified man-machine system, and not separately with one subordinated to or totally replacing the other. We need to retain our human traits and not let them melt in the heat of technology. We have slipped but can retain balance by doing certain things:

- Don’t make too many long-term plans for oneself when there is so much change in the air. Short term plans will give more opportunities to experience successes and let the mind gain control over one’s life.

- Unclog the mind by reducing inputs to the mind rather than seeking more. Especially the barrage of messages from various digital platforms. The human brain was not designed for so much clutter.

- Fight loneliness in a crowd by seeking deeper relationships with much fewer people than shallow relationships with more people. This shift is easier if one takes a daily break for lunch or tea with a friend or two while not looking at devices, to talk to each other without judging or being judged. Topics to talk about will evolve. Digital messages will wait without your immediate attention.

- Nourish your body, it will help reconnect with the mind. Start some daily rituals like even a short walk in the sun, exercise, etc. which one has sacrificed at the altar of modern life.

- Avoid the pressure to be ‘numero uno’ at everything. Such heroes are only in movies.

- Create a few slow and deliberate activities in an otherwise rushed day. Modern life has eaten into such activities. The human mind needs a rhythm -not be fast paced all day.

- Take a few deep breaths each time, you feel stressed.

- Avoid investing in cryptocurrencies which are neither currency nor investment assets. They are just speculative instruments that will create moments of joy and sorrow, which are completely outside your control.

These suggestions could probably restore a sense of control on one’s life by mak ing it a bit more comfortable to navigate the uncertain world and to not get even a Bit-Conned by modern life.

Summary:

The world economy did not topple in 2025 despite all the turbulence. Since USA is and will remain the dominant pole in international trade and relations, a lot of what will happen in 2026 is tied to US Tariffs, new US policies relating to climate change, insourcing of manufacturing, visas, combined with sanctions (including secondary) arising from the war in Ukraine and US-China tensions, etc. It is creating fissures in the global order. However, intelligent guesses based on multiple factors, seem to suggest that the global GDP growth 2026 will only be marginally lower than in 2025. Many countries have protected themselves by partially diversifying market and payment platforms.

There will, however, be increased anxiety in the human population. Social Capital has suffered due to some of the above and due to technology invading their mind space. This will need urgent intervention. Some issues and interventions required for self-help in 2026 have been addressed above as pointers without any pretence of any degree of professional rigour. Finally, don’t worry about an unlikely AI Bubble burst in 2026 (you are safe since you are not an investor yet) but don’t get conned by Cryptocurrency by treating it like a currency or an investment asset; they are clearly not. It is a speculative instrument with no intrinsic value.

One last thing:

I have been getting several warm messages over the past several years for correct predictions especially the unexpected ones. Here is the secret-they were all anticipation by joining the dots rather than predictions. Try it out yourself. List the most unexpected future events, things that rose too fast recently, whatever looks magical, etc. There is usually some hidden truth, good or bad. e.g., 1. Anticipate future demand for nuclear power plants by noticing that AI usage is skyrocketing (AI is extremely power hungry and there are not many options to increase power supply). Connect that with something down the road. Copper prices will rise. Easy, what else? Cameco’s stock price has risen 300% in 3 years because they acquired 49% in Westinghouse Electric in 2023 around the time ChatGPT became widely available. Couldn’t you have anticipated that when the GenAI burst into the scene before 2025, when the US Government announced an USD 80 billion nuclear power build, based on Westinghouse technology? 2. Ireland’s GDP rose by 25% in 2015. Very unusual. Corp tax collections in the US tanked that year and after. Ireland’s GDP rocketed only because they dropped Income tax sharply and got global MNC to shift their HQ to Ireland. MNCs obliged. USA finally dropped tax rates sharply in 2018. Could that have been anticipated?

Both Surprising? No. This is how, I made all my previous annual predictions. Your turn now. Which car company achieved unbelievable success in 2025? BYD, the most successful EV company in the world in 2025. The most beautiful EVs, very efficient, the best EV batteries, high growth, etc. Can a problem brewing below the surface be anticipated? Please do reply at raj.nair@consultavalon.com. Hint: Over stretched finances. Keep tracking the EV ecosystem in 2026.