This blog explores isobutanol as a promising candidate for diesel blending in India, driven by the need to reduce crude imports and improve energy security. It highlights isobutanol’s superior blend stability versus ethanol/methanol, outlines capex-light production potential through retrofitting excess ethanol capacity, and assesses the viability gap requiring policy support. It concludes with adoption barriers across technology maturity, economics, regulation, and ecosystem readiness.

Market & Strategic Implications

India’s recent interest in exploration of iso-butanol blending falls in line with the national biofuels policy of 2018. It can be directly linked to the country’s ambition to reduce crude oil imports and thus the vulnerability it faces from global market volatility, hence strengthening our energy security and providing with more resilience to global shocks.

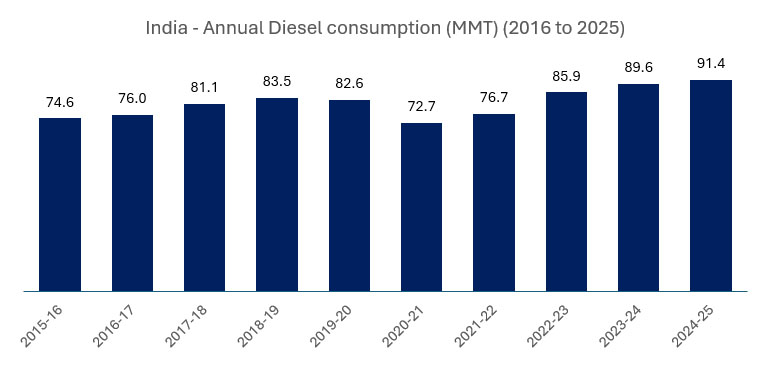

India’s consumption of diesel stands at roughly 91.4 million tons as of FY 24-25, which constitutes about 39% of all petroleum products consumed. This large volume presents a substantial opportunity of substitution through blending of domestically produced alternative fuels. Although quite a few options are in the potential pipeline, iso-butanol has recently emerged as a strong candidate owing to its unique properties which provide for a better suitability for this initiative.

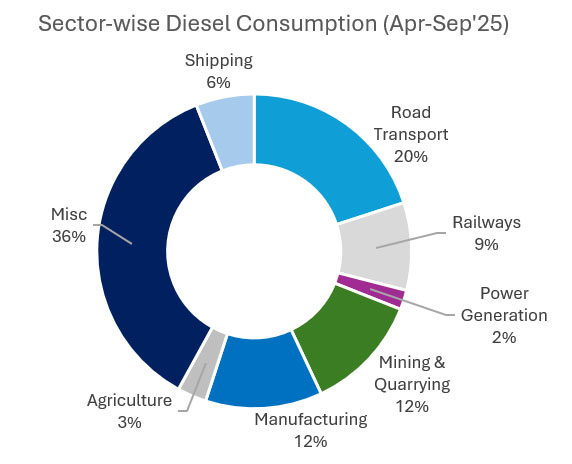

India’s diesel consumption for the current financial year upto September’25 stands at 45.8 MMT. The consumption pattern is distributed across sectors, ranging from transportation to power generation.

The Iso-butanol Differentiator

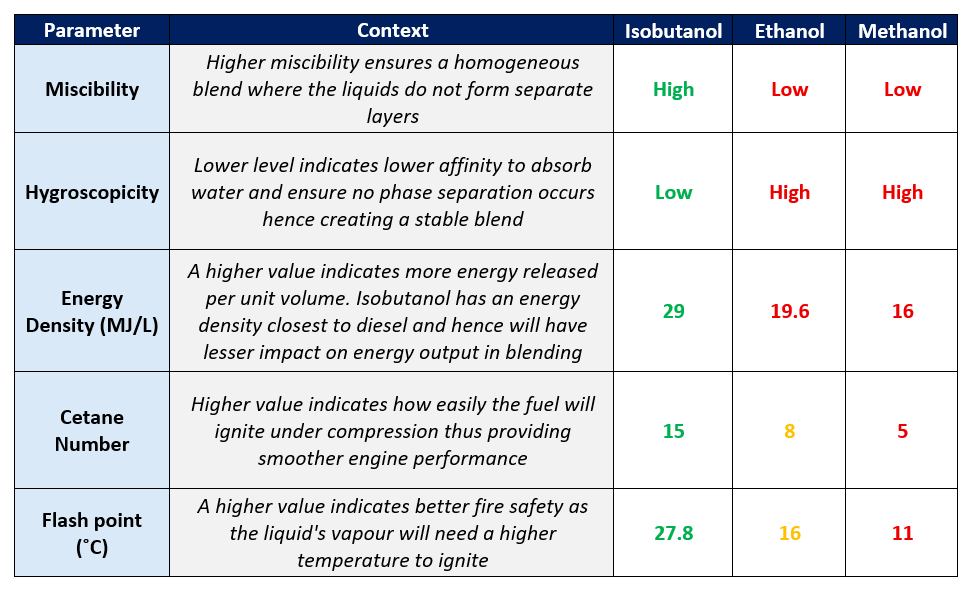

There are several factors which make isobutanol a much more suitable choice for diesel blending when compared to other potential alternatives such as ethanol and methanol. The key indicators are as follows:

- Isobutanol shows high miscibility and is able to form a homogeneous mixture with diesel without any phase separation, confirming its commercial readiness as a drop-in fuel additive. This addresses a major issue with blending Ethanol with diesel

- Reduced power for different blending ratios with higher ratios reflecting lower brake power. The average decreases in the break power is ~1.5% for 10% blended diesel fuel

- The mass of fuel consumed per unit of power produced (BSFC) showed an increase of ~3% for the same 10% blended diesel. This is equivalent to the ~7% drop in fuel efficiency for 20% Ethanol blended petrol.

Retrofitting Excess Capacity Ethanol Plants for Isobutanol

Isobutanol has 2 major production routes: Chemical synthesis and biological fermentation. Biological fermentation is expected to gain prominence in India, following the path established by bio-based ethanol. Drawing similarity from the ethanol production process, the isobutanol setup can be achieved by minor changes to the already existing ethanol production process. This provides a unique opportunity for ethanol producers to diversify their products at a time when the ethanol capacity of the country stands at around 15-16 billion liters against a requirement of approximately 12 billion liters for E20 blending targets.

Global technology developers such as Gevo have developed proprietary processes that enable the retrofitting of existing ethanol plants to produce isobutanol. Compared to greenfield projects, such retrofits typically require significantly lower capital investment (Estimated $17 Mn for 68 Mn liters), as core infrastructure can be reused.

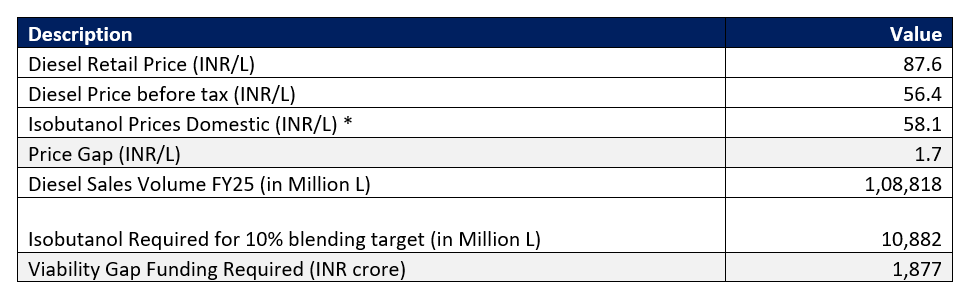

Viability Gap Funding

The prevailing market price of Isobutanol is slightly higher than the pre-tax price of diesel, creating a small viability gap that must be addressed through government support to enable an effective transition. * The isobutanol prices considered are based on chemical synthesis route

* The isobutanol prices considered are based on chemical synthesis route

Drawing a parallel with the Ethanol Blending Program, it can be inferred that the post-blending retail price of diesel would remain unchanged, thereby preserving existing tax collections on diesel.

R&D and pilot projects

- Union Minister for Road Transport and Highways, Nitin Gadkari, stated in 2025 that the Automotive Research Association of India (ARAI) is conducting trials to evaluate a 10% isobutanol blend in diesel fuel

- Praj Industries, in partnership with Gevo Inc., is setting up a demonstration-scale fermentation module at a sugar mill in Maharashtra to produce isobutanol from molasses and sugarcane juice

- Kirloskar unveiled gensets powered by blended isobutanol, demonstrating the feasibility of diesel substitution in stationary equipment

These projects indicate the ongoing preparation from different industries to cater to the diesel isobutanol blending when the necessary policy and regulatory changes get introduced

Policy and regulatory support: Biofuels Mandates and SAF Adjacencies

Policy signals also provide a supportive backdrop:

- National Policy on Biofuels, 2018: Surplus biomass availability offers potential for production of bio-methanol & bio-butanol. An indicative target of 5% biodiesel blending is proposed by 2030

- GST rate for biodiesel supplied to the OMCs for blending with diesel was reduced from 12% to 5% from October 2021

- Isobutanol can also be used for processing SAF. India had embarked on a Sustainable Aviation Fuel (SAF) Feasibility Study. The targets are set at 1% blending by 2027, 2% by 2028 and 5% by 2030

Scale potential is real—but adoption hinges on economics, policy clarity, and ecosystem readiness

Isobutanol presents a credible pathway for diesel blending, offering better blend stability than ethanol or methanol and a relatively lower energy penalty. India’s excess ethanol capacity could potentially be repurposed through retrofits, enabling faster scale-up with lower capex than greenfield plants. However, wide-scale adoption will require overcoming key barriers. A parallel can be drawn with CBG, where real-world operating conditions have often delivered yields lower than theoretical assumptions, highlighting the importance of pilot-to-commercial learning loops before national scale-up.