Ketaki Nair, Associate Consultant at Avalon Consulting, authored her views on Premium Is the New Mass Market in Indian Retail.

She highlighted how premiumisation is reshaping India’s retail landscape, driven by rising incomes, aspirational consumption, and digital adoption across Tier 1 and Tier 2 markets. The article notes that premium and premium-plus segments especially in apparel and FMCG are redefining consumer expectations, with omnichannel presence, quality, and local relevance emerging as key growth enablers.

India’s retail sector is undergoing a structural transformation. While mass-market consumption continues to be the backbone of retail revenue, the real growth story is now being written at the top end. Premiumization is reshaping consumer preferences and retail strategies.

This shift is evident across categories – from apparel to dining to consumer electronics – due to a range of factors that have sharply increased both purchasing power (due to higher disposable incomes and a ready availability of consumer finance) and aspirational consumption, across both Tier 1 and Tier 2+ markets. This is accentuated by the increasing digitisation of retail; high smartphone penetration and the expansion of digital platforms have made global brands and premium products more visible, accessible and appealing to Indian consumers.

Table 1. Growth Drivers of Premium Retail Products

| Driver | Insight |

| GDP Growth | ~ 6.3% YoY growth forecast for FY25-261 |

| Expanding Middle Class | 430 Mn FY25; projected to reach 1 Bn by 20502 |

| Youth Dominance | 66% of population under the age of 35 (over 808 Mn people)3 |

| Digital Access | 900 Mn+ internet users |

| E-commerce Surge | Retail GMV projected to reach USD 170–190 Bn by 20305 |

The presence of global brands and premium products has amplified offline as well. Superior-grade malls, such as the Jio World Plaza and Galeries Lafayette, are growing ubiquitous across leading Indian cities. Over 70% of the new Grade A mall supply anticipated in India by 2027 will fall under the superior grade category, according to a report released by real estate consulting firm Cushman & Wakefield, with higher-end categories like jewellery, athleisure, etc. set to increase their share of occupancy to 40% over the next few years, from the current sub-10%6.

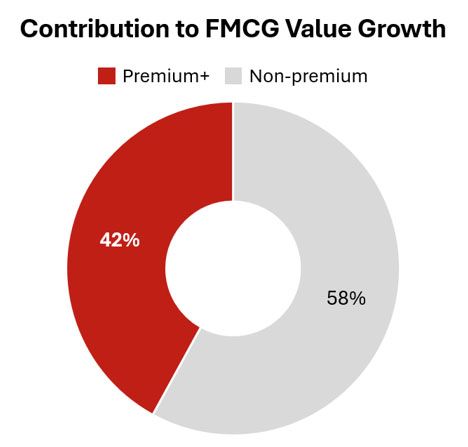

These phenomena reflect the growing trend of retail premiumisation in India – wherein consumers are demonstrating an increasing willingness to pay more for products with a higher perceived value. This is evident in a recent NielsonIQ report, which depicts the rapid growth of premium and luxury FMCG products. Premium brands in the sector have reached double-digit growth, almost twice of what has been achieved by their non-premium counterparts. Furthermore, this growth is mostly organic, as consumption value is growing at nearly twice the rate of price increase. The premium+ segment now accounts for around 27% of total FMCG sales and contributes a weighty 42% of the sector’s value growth7.

Retail premiumisation is not solely emerging as a niche luxury trend; instead, it is redefining the baseline expectations of the mass-market consumer across Indian markets.

Apparel has been significantly impacted by this wave of baseline retail premiumisation; growth is concentrated in the premium apparel segment, which combines quality, aspirational branding and access, factors that attract India’s growing consumer base of fashion-conscious youth with rising disposable incomes. This growth is visible in Tier 2 and Tier 3 cities as well, which are experiencing rapid HNI growth as well as greater demand for luxury residences, developments that herald a growing customer base for premium products.

Recent apparel entrants in the Indian market also reflect this trend; in the last 5 years or so, more than half of the brands launched have been premium+, such as Andamen, Bombay Shirt Company, etc., and several premium global brands have launched successfully, such as Ecco, Kylie Cosmetics, and Maje.

Two significant cases to take a deeper dive into are Uniqlo India and the homegrown brand Snitch:

Case Study 1 : Uniqlo India

Since entering India in 2019, Uniqlo has focused on offering global-standard quality at premium prices. Their strategy has focused on timeless, long-lasting designs, local adaptations (breathable fabrics, ethnic-fusion kurtas), omnichannel reach (17,000+ pin codes), and partial local sourcing (15%) – a strategy that has met with resounding success. In FY24, Uniqlo India surpassed INR 5 Bn and is set to hit the INR 10 Bn mark in FY25, expanding to new locations in Tier 1 and emerging cities8.

Case Study 2: Snitch

Snitch, a fast-growing and digital-first native menswear brand, exemplifies the rise of premium apparel in India. With higher price points, a focus on trends, and a fast inventory cycle, they have catered to India’s expanding young, style-conscious, and wealthier consumer base.

The brand’s move into upmarket mall locations points to an omnichannel strategy, aligning digital reach with elevated in-store experiences. Snitch’s FY24 revenue reached INR 2.5 Bn and the brand is eyeing double that revenue in FY259.

The success of these brands and the growth in demand for premium products across retail sectors in India suggests that brands must recalibrate their strategies around quality, access, and localized relevance to succeed in India’s increasingly pan-premium market.

Key takeaway for brands:

- Premium aspirations are no longer confined to the top tier; Tier 2 and Tier 3 cities have become home to rising number of HNIs and customers of premium retail. Entering these markets now is crucial for brands, as waiting for traditional maturity curves will mean losing first-mover advantage.

- A strong omnichannel presence is important for brands to offer an end-to-end premium retail experience – e-commerce product pages should emphasize craftsmanship, provenance, sustainability, not only SKU specs.

- The Indian market is ready for premium brands. A young, upwardly mobile consumer base, rising HNI counts, and a maturing premium retail ecosystem—from superior-grade malls to local sourcing and digital enablement—signal a clear readiness for premium brands. For players on the fence, now is the time to enter or expand.

The wave of premiumisation further foreshadows a significant opportunity for Indian enterprises. Beyond being a consumer base, India’s businesses could play a greater role in delivering inputs, components, and services to both global and domestic premium brands. The potential for India to deepen its role not just as a market, but as a value creator in the premium retail ecosystem, is worth exploring further—and will be the focus of an upcoming analysis.

India’s retail sectors are not bifurcating into a small luxury segment and a stagnant mass market. Instead, premiumization is reconfiguring demand, pricing and positioning across the retail value chain. Growth is being driven not just by income, but by aspiration, visibility, and access—trends growing strong beyond Tier 1 cities. Additionally, omnichannel strategies are becoming essential, blending digital convenience with curated offline experiences to meet rising expectations across touchpoints. These are strategies crucial to make use of, for both local and global brands, as India becomes a pivotal market for long-term, premium-led growth.