As digital payments grow in volume and shrink in value, brands are reshaping how consumers spend. Sarath explores the shift from high-value UPI transfers to low-value, impulse-driven purchases, revealing how embedded finance and frictionless checkout experiences are redefining growth strategies for businesses in India.

How many of you have recently checked your Google Pay / Phone Pe transaction history and thought:

“Wait… when did I even spend this money?”

Or maybe some of you started working before the UPI era—

Can you relate to whether your spending patterns have changed over the past years?

Or worse… are you worried that your siblings or kids are slowly turning into part-time Swiggy shareholders, based on how often they order food?

If that sounds familiar and you are seeing similar patterns around, this article might be relatable, since we’ll explore how the rise of impulse-driven spending, enabled by technology, is fueling a surge in digital transactions. At the same time, consumer-facing apps with embedded payment features are setting new benchmark models to capitalise on this behaviour, offering valuable lessons and opportunities for smaller players to replicate or adapt these strategies in response to evolving consumer patterns

Rise in Impulsive spending

Recent research from a study by FIS Global on increasing willingness of Indians to adopt embedded finance solutions highlights how convenience-driven digital payment methods like UPI—along with the growing influence of instant gratification and incentives—are shaping purchasing behavior. The study found that approximately 76% of Indians use UPI for online checkouts, with this number rising to 84% among millennials [10]

About 63% of participants cited the convenience of a two-click checkout process as a key factor influencing their buying behaviour [10]. Marketing teams of applications such as Uber, Amazon, Swiggy, and Zomato have effectively capitalised on this trend by providing a range of seamless payment options, majorly UPI, allowing users to complete transactions with minimal effort

Furthermore, 72% of users consider discounts and coupons offered by these platforms when making purchases, while 63% are influenced by rewards and cashback benefits integrated into these apps[10]. These findings underscore the rise of impulsive spending behavior and demonstrate how marketing strategists are actively leveraging this shift in consumer habits to drive more low-value, impulse purchases

The rise of UPI: Game Changer

The rise of UPI has significantly influenced the entire digital payment ecosystem in India. Launched in 2016 with just 21 banks, UPI has grown rapidly to include 661 banks by March 2025 [1]. Today, it contributes to approximately 83% of all digital transactions, far outpacing cards, NEFT, wallets, and other previously dominant payment modes [2] The stark contrast becomes evident when we consider that in 2019, UPI accounted for only 34% of digital transactions, while cards and other methods made up nearly two-thirds of the total [3]

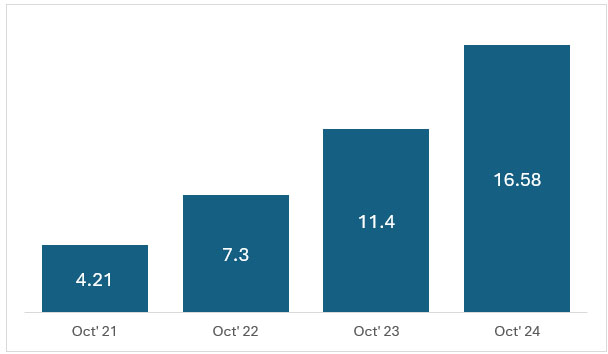

According to the Press Information Bureau (PIB), monthly UPI transactions grew from 4 billion in October 2021 to 17 billion in October 2024 [4]. Similarly, the total transaction value increased from ₹7 lakh crore to ₹23 lakh crore over the same period [4]

UPI Transactions Volume

(In Billions)

But there’s another side to these impressive numbers. A closer look of the above numbers reveals that the number of transactions is growing faster than the total transaction value, indicating a decline in average ticket size [4]. This trend becomes clearer when we consider the bigger picture — a notable shift in UPI usage from high-value person-to-person (P2P) transfers to low-value person-to-merchant (P2M) transactions

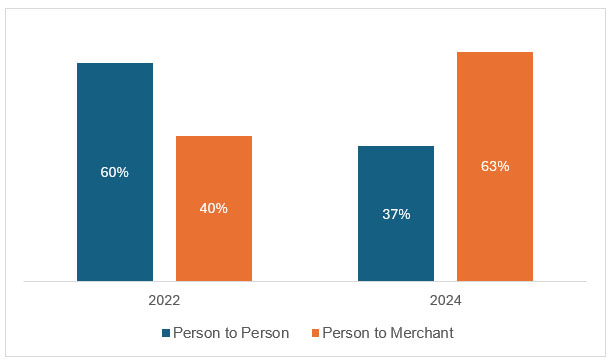

P2P to P2M shift of Digital Transactions

Person-to-merchant (P2M) transactions, which accounted for just 40% of all UPI transactions at the beginning of 2022, have grown to 63% in 2024 and now dominate the UPI landscape

Shift of UPI Usage from P2P to P2M Transactions

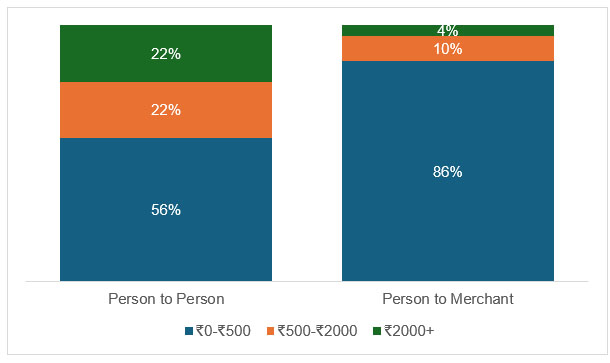

Of this 63%, almost 86% of transactions fall within the ₹0–₹500 range. In comparison, for person-to-person (P2P) transfers, about 56% of transactions are below ₹500 [5]. P2P transactions still include a substantial share of higher-value transfers — around 44% are above ₹500, and within this, 22% exceed ₹2,000[5]. In contrast, small-ticket transactions dominate the P2M segment. Transactions above ₹500 account for less than 14%, while nearly half of all P2M transactions are below ₹200 [5]

Transaction Distributions

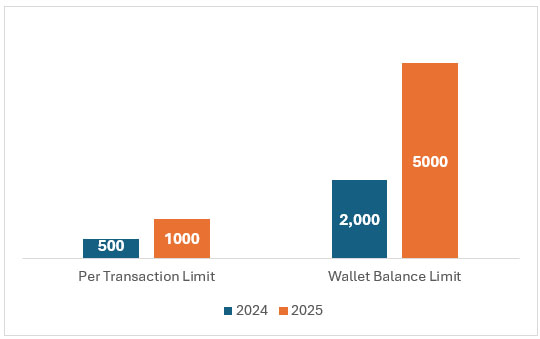

This growth in P2M (person-to-merchant) payments is not accidental; it has been driven by incentives and infrastructure support aimed at encouraging merchant adoption by relevant stakeholders. In 2022, National Payments Corporation of India introduced UPI Lite, a simplified version of the Unified Payments Interface (UPI) designed for small-value transactions. It allows users to make payments of up to ₹500 per transaction without needing a PIN and has a maximum wallet balance limit of ₹2,000. This limit was later increased in December 2024 to ₹1,000 per transaction, with a daily limit of ₹4,000 and a maximum wallet balance of ₹5,000 [6]

UPI Lite Transaction Limits 2024 vs 2025

In 2023, NPCI launched UPI Lite X, which leverages Near Field Communication (NFC) technology to enable small-scale money transfers between on-device wallets and works even in offline mode [7]. UPI Lite is particularly useful for individuals in rural or semi-urban areas with limited internet access, enabling offline payments. UPI 123 is another initiative by UPI that allows users with feature phones, without any smartphone capabilities, to make transactions through an IVR number and other options without the need for internet access [8]

The Government also prioritises promoting low-value digital payments to enhance financial inclusion and provide more payment avenues for the common man. Recent initiatives include a ₹1,500 crore incentive scheme for low-value BHIM transactions to encourage digital payments among small-scale merchants [9]

According to NPCI, a Merchant Discount Rate (MDR) – the service charge paid to payment processing companies of up to 0.30% is applicable for UPI P2M (Person-to-Merchant) transactions, which is still lower than the 0.9% typically charged by card networks for debit card transactions [9]. Since January 2020, to promote digital transactions, MDR has been waived for RuPay Debit Card and BHIM-UPI transactions through amendments to Section 10A of the Payments and Settlement Systems Act, 2007, and Section 269SU of the Income-tax Act, 1961, with the Government compensating these companies through incentives to promote low value digital transactions [9]

Impulse to Revenue: How Apps Drive Small-Ticket Digital Transactions

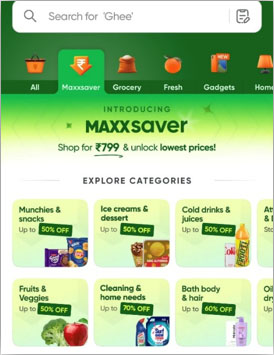

If you’ve seen messages like “Add ₹100 more and save ₹40” in your favourite quick commerce applications, you’ve already encountered one of the benchmark strategies used by embedded finance consumer applications to drive impulsive purchases. Bulk order discounts are a key initiative adopted by embedded finance applications like Swiggy, Zepto, Blinkit, and others to tap into impulsive spending patterns. These platforms encourage top-up purchases by offering instant discounts to boost Average Order Value (AOV), and companies are introducing new innovations in this business model l. Swiggy Instamart recently launched Maxx Saver, a discount-led strategy aimed at increasing average order value—directly positioned against Zepto’s Super Saver. Unlike Zepto, where customers need to browse the Super Saver section manually, Swiggy embeds these bulk order discounts directly into the cart experience. The discounts are automatically applied at checkout, making the process frictionless and more effective in nudging users toward higher-value purchases

Bulk order Discounts: Swiggy Maxxsaver

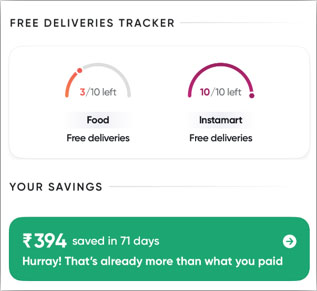

Another benchmarking model is embedded subscriptions, which offer many benefits, including removing the delivery fees. For example, Swiggy offers Swiggy One membership, including a new version called One Lite. The One Lite plan provides 10 free food deliveries from any restaurant within a 7 km radius, and 10 free Instamart deliveries, provided the order value exceeds ₹199. This setup encourages customers to add more items to avoid delivery charges. Additionally, members often feel the urge to place more orders due to the temptation of maximising their subscription benefits, again resulting in impulsive spending

Embedded Subscriptions: Swiggy One Lite

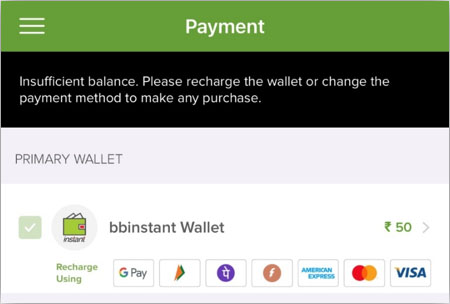

UPI applications have long facilitated avenues for impulsive spending, most notably through scratch cards and cashback incentives offered on specific transactions. A more distinctive method includes wallet lock-ins, where platforms like Amazon Pay encourage users to top up their wallets to avail cashback offers — funds that may later be required for processing future payments. Retail applications like BBinstant are also adopting this model in their smart vending machines, where users must load an initial amount into a wallet. While this often comes with cashback incentives, it effectively locks the money within the system, prompting users to make additional transactions to fully utilize or “unlock” the balance. This is a model that more e-commerce platforms could adopt, enabling smoother and more habitual purchases without relying entirely on UPI for completing every transaction

BBInstant Wallets

Beyond UPI

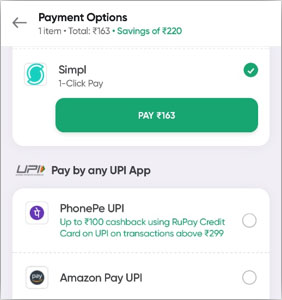

Apart from UPI, Buy Now, Pay Later (BNPL) applications such as Zest Money, Lazy Pay, and Simpl, which offer similar convenience of UPI, are increasingly gaining traction in embedded finance applications. These platforms offer the added benefit of deferred payments, attracting users who value flexible payment options, thereby making impulsive purchases easier and more frequent

BNPL Applications: 1 Click Pay

According to a recent study by Business Wire, the BNPL market in India grew at a CAGR of 22% between 2021 and 2024 and is projected to reach USD 21.95 billion by 2025 [11]. The report highlights the untapped potential of India’s expanding digital economy as a key factor driving the entry of new BNPL providers. Moreover, strategic partnerships between BNPL companies and e-commerce platforms have enabled seamless integration of these payment solutions, significantly enhanced accessibility and accelerated consumer adoption

Looking ahead, BNPL providers are expected to focus on penetrating tier-2 and tier-3 cities by collaborating with e-commerce/ retail players and tailoring their offerings to meet the unique needs of these regions. However, despite the upward trajectory, regulatory concerns – particularly the restrictions on allowing prepaid payment facilitators to function as loan providers propose significant challenges. These limitations are prompting BNPL firms to reassess and adapt their business models in order to stay compliant and ensure sustainable growth

Closing Thoughts: Bringing Credit Cards to the game

There is significant scope for improvement in digital spending if the credit card market can be enhanced with the same ease of use that UPI currently provides. At present, only RuPay credit cards, accounting for nearly 16% of all credit card spending, are integrated with UPI, with nearly half of these transactions made via credit on the Unified Payments Interface (UPI), according to NPCI [12]

If major players like Visa and Mastercard are also integrated with UPI, like RuPay, it would provide consumers with greater freedom to spend using their credit limits rather than being constrained by the balance in their UPI-linked bank accounts. This shift could drive a significant increase in digital transactions and unlock more of the market’s potential.

Sarath Krishnan V.K

An MBA candidate at IIM Trichy with a recent summer internship at Avalon Consulting, contributing to user experience enhancements at a major South Indian airport. Previously served as a Senior Business Analyst with three years of experience in account management, delivery, and business development at a premier cloud implementation partner for Google and AWS. Holds a B.Tech in Computer Science from the College of Engineering, Trivandrum.

Email: sarath.vk@consultavalon.com