Ganesh Shewatkar, Associate Vice President, and Shubham Sanghavi, Consultant at Avalon Consulting, co-authored an article on Innovative Financial Instruments: A Necessity for India’s Disaster Risk Management.

They examined the growing fiscal challenges India faces due to increasing natural disasters and emphasized the need for innovative financial solutions such as catastrophe bonds. Drawing from global best practices, the authors highlighted how structured financial instruments can enhance disaster preparedness, reduce the burden on public funds, and attract private investment into climate resilience.

Innovative Financial Instruments: A Necessity for India’s Disaster Risk Management

India faces a significant challenge in managing the financial repercussions of natural disasters. In 2023 alone, the nation incurred losses exceeding ₹1 lakh crore (approximately $12 billion), with cumulative losses surpassing $80 billion over the past two decades. The increasing frequency and intensity of these events underscore the urgent need for innovative financial mechanisms that can diversify risk and ensure effective disaster funding. Among such measures, catastrophe bonds (cat bonds) stand out as a promising solution that can reduce the government’s financial burden while also attracting investments from global capital markets.

The Growing Challenge of Natural Disasters in India

Natural disasters such as floods, droughts, cyclones, and landslides have become increasingly common in India, with climate change amplifying their severity. Recent catastrophes, including devastating floods in Sikkim and Chennai, have highlighted the vulnerabilities of India’s current disaster management strategies. These events have strained both public and private resources, exposing the inadequacies in existing risk management frameworks.

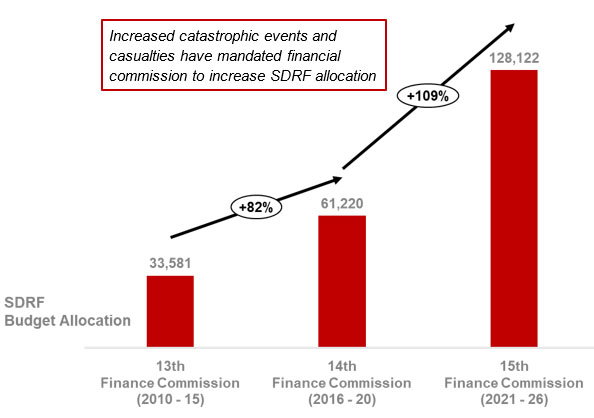

India’s current disaster financing mechanisms, largely reliant on the State Disaster Response Fund (SDRF) and National Disaster Response Fund (NDRF), are under growing fiscal strain as natural disasters intensify. The 15th Finance Commission allocated ₹1.28 lakh crore for SDRF and ₹54,770 crore for NDRF for 2021-26, a significant increase from previous allocations, reflecting the escalating costs of disaster management. National Budget should include provisions for alternate risk hedging mechanisms to address this gap, which is crucial for building resilience against natural disasters.

Catastrophe Bonds: A Strategic Opportunity

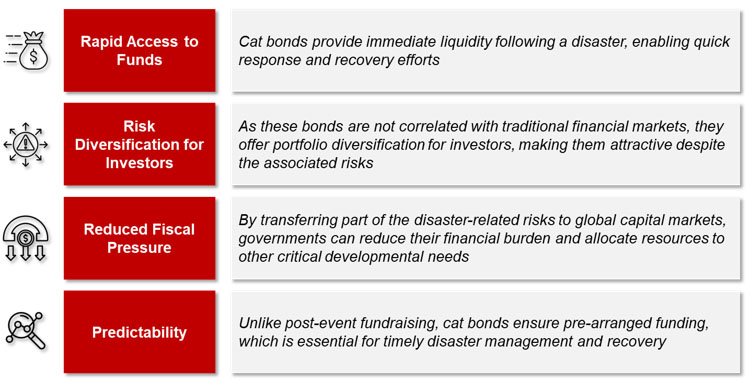

Catastrophe bonds, a type of insurance-linked security, enable governments and insurers to transfer disaster-related risks to investors. The structure of these bonds typically involves investors receiving regular interest payments, with the risk of losing their principal if a specified disaster occurs. Alternatively, payouts can be deferred, depending on the bond’s structure, ensuring funds are allocated precisely when needed for recovery and reconstruction efforts.

This pre-arranged funding mechanism stands in stark contrast to India’s current reliance on fiscal allocations and emergency relief measures. By integrating instruments like cat bonds into disaster financing strategies, India can create a proactive and predictable system for disaster recovery—an approach strongly advocated by institutions such as the Impact and Policy Research Institute (IMPRI).

Benefits of Catastrophe Bonds

Balancing Opportunities with Challenges

Despite their advantages, cat bonds are not without risks. Investors face the possibility of losing their principal if predefined disaster conditions are met. For governments, poorly structured bonds can lead to either insufficient payouts or excessive costs. Therefore, it is crucial to calibrate the conditions of the bonds carefully, considering factors like payout triggers, geographical coverage, and disaster probability.

For instance, a narrowly defined trigger may delay payouts if the disaster falls outside specific parameters, while overly broad triggers could result in unnecessary financial outflows. Lessons from countries like Mexico, which have effectively used cat bonds for earthquake coverage, emphasize the importance of robust risk modelling and clear terms to ensure the bonds serve their intended purpose.

Insights from Global Success Stories

Globally, countries such as Mexico, Chile, and the Caribbean nations have demonstrated the efficacy of cat bonds in disaster risk management. Mexico’s MultiCat program, for example, has been a benchmark in using cat bonds to secure timely payouts for earthquake recovery. Similarly, the Caribbean Catastrophe Risk Insurance Facility (CCRIF) pools risks across multiple nations, lowering costs and enhancing regional resilience.

These examples highlight the importance of collaboration, precise risk assessment, and well-structured financial instruments. By adopting similar practices and tailoring them to India’s unique disaster profile, policymakers can maximize the benefits of cat bonds.

Strategic Recommendations for India

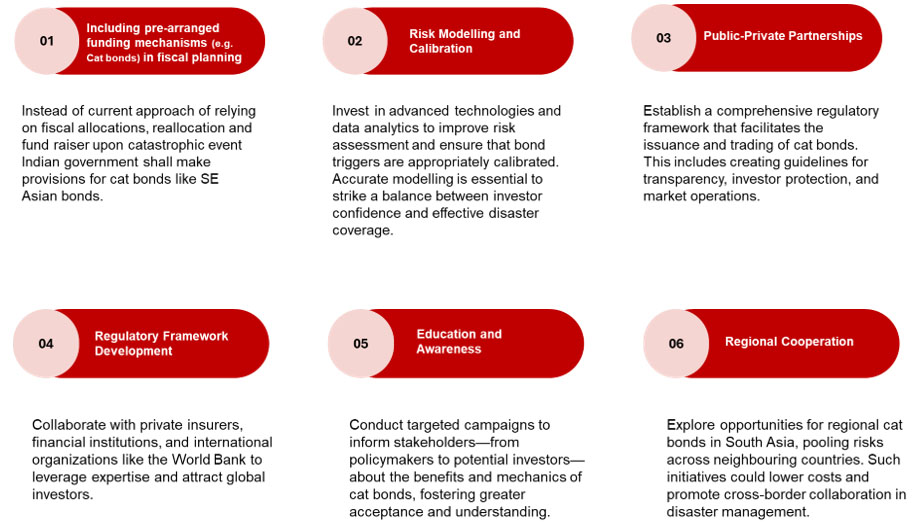

To harness the potential of catastrophe bonds, India should adopt a multi-faceted approach:

Navigating the Road Ahead

As the frequency and intensity of natural disasters continue to rise, India’s reliance on traditional disaster financing methods is increasingly unsustainable. Catastrophe bonds offer a transformative opportunity to enhance the country’s disaster resilience while reducing fiscal strain. However, realizing this potential requires a careful and calibrated approach.

Policymakers must prioritize robust risk assessment, transparent regulatory frameworks, and strategic partnerships to ensure that cat bonds are both effective and attractive to investors. By integrating lessons from global success stories and tailoring solutions to India’s unique needs, the government can unlock the full potential of these innovative financial instruments.